Each week we share business ideas and opportunities that you can use to build your next big business.

We’ve decided to experiment with the format a bit. The past few newsletters were getting too long and the content curation section was getting cut in people’s inboxes. So, we’ve decided to split the newsletter into Industry Deep Dives on Wednesday and the Content Curation on the weekends. Let us know what you think about this experiment!

In today’s Newsletter, we’ll do a deep dive into Warehousing in India and the business opportunities it brings!

Disclaimer: Warehousing is a complicated & nuanced topic - we’ve done our best to give an overview of the current scenario in India but there may be many nuances we missed. Let us know if we missed anything important.

Move TID to Primary!

If you’re reading this on Gmail and our mail dropped into your Promotions Inbox - please drag and drop us into your Primary Inbox, it’ll help us a tonne.

🏢 Warehousing in India

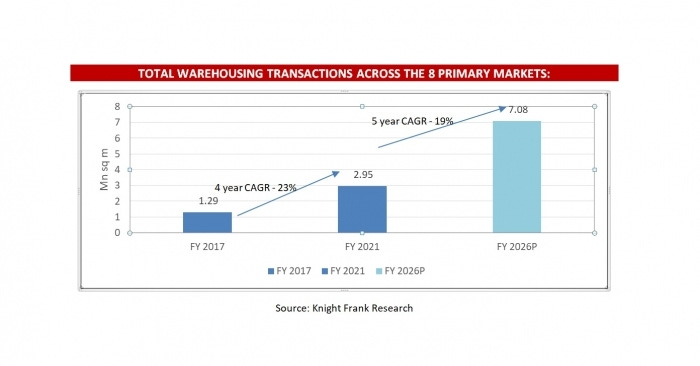

What do you imagine when you think about warehousing in India? Musty old godowns filled to the brim with gunny bags? This is still the vast majority of warehousing in the country - but the industry is changing fast. Growing at double digits per year, millions of square metres of new warehouses are expected in the 2020’s along with nearly $10 Billion in investments over the next 4-5 years. The musty godowns may soon be a legacy of the past.

Modern warehouses in India are palletised, automated and designed for efficiency. Modern Warehouse Management Systems (WMS) and other IT driven solutions help create a sophisticated and efficient warehousing network that provides integration with automatic material handling equipment, cross-docking, yard management, labour management, billing and invoicing, etc.

Why is Warehousing changing?

Regulatory Change Led to Easier Financing

The Logistics industry was granted ‘Infrastructure’ status in 2018 allowing the industry (including warehousing) to acess funds at a cheaper rate. Lower interest rates → lower project risk → more warehouses being built. This has benefitted and led to more free trade warehousing zones (FTWZs) and logistic parks.

Growth of Ecommerce & 3rd Party Logistics (3PL)

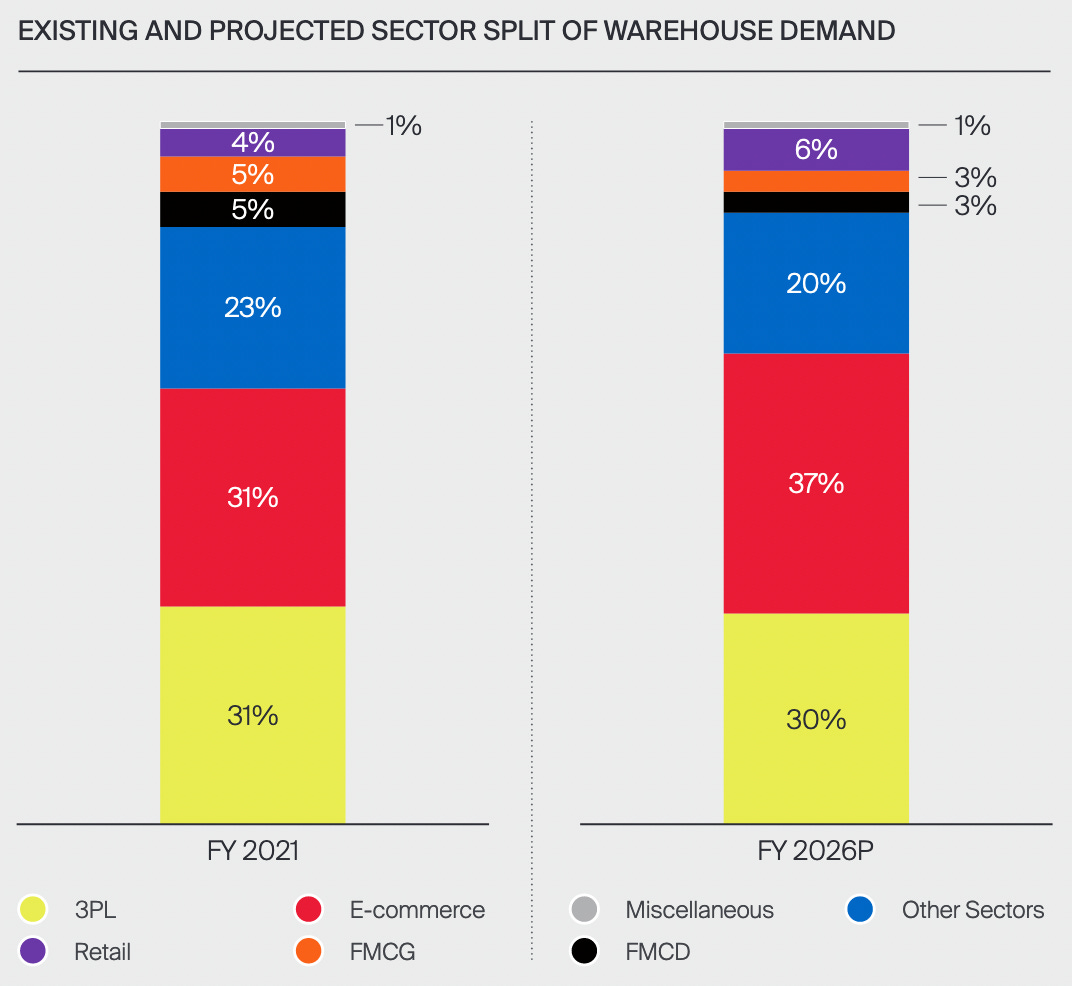

The 2 primary use cases of modern warehouses are 3PL and e-commerce which together contribute to 60+% of the warehousing demand in India.

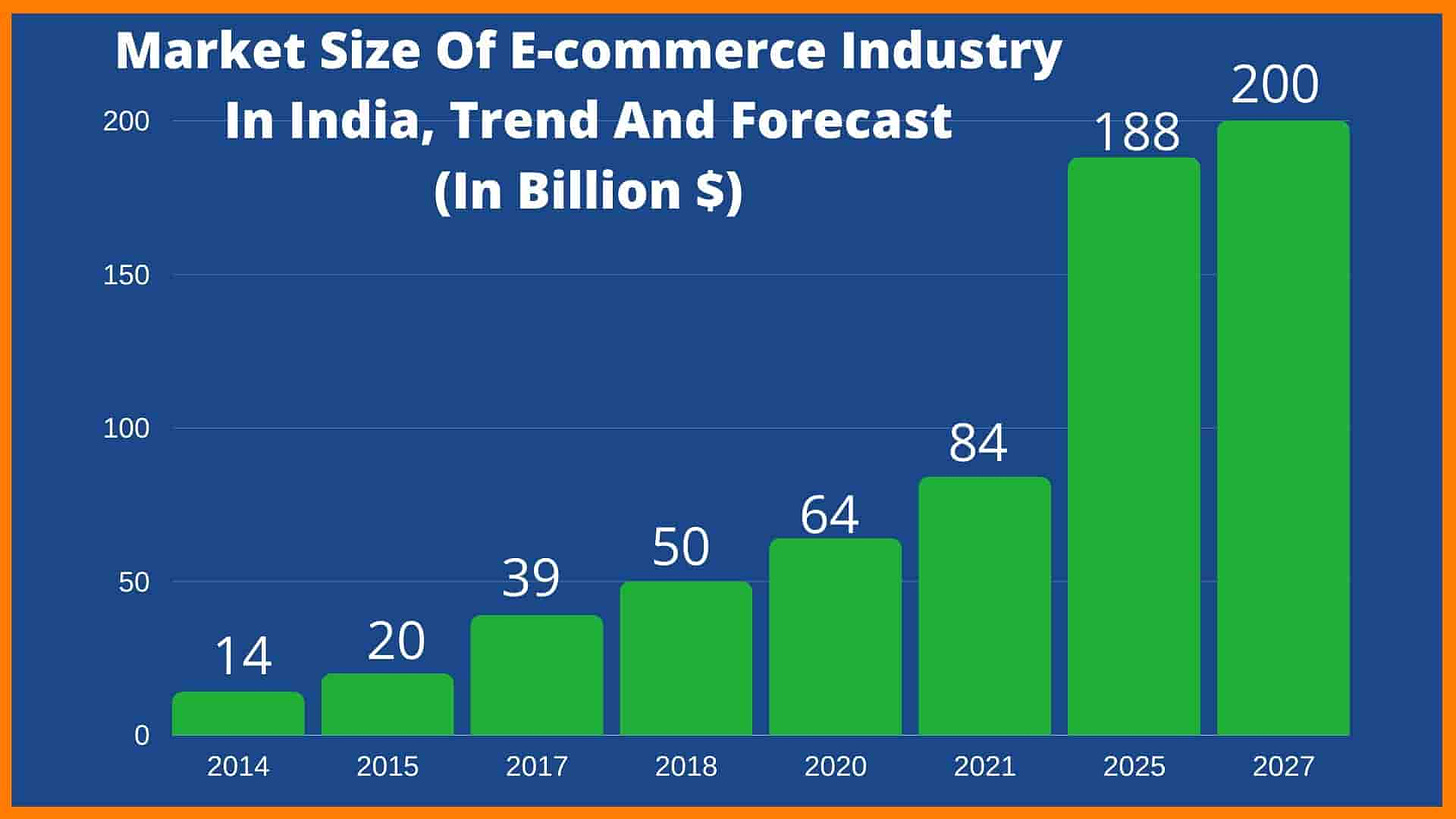

Ecommerce has been growing at 20+% for years. Whether you’re Amazon or a digital-only D2C brand, you need to store your products somewhere before shipping them across the country. Giants like Amazon and Flipkart also need significant in-city warehousing for last mile delivery to reduce delivery timelines.

As much as digital entrepreneurs would love it, no business can exist without physical infrastructure.

The growth of 3rd Party Logistics (3PL) which handle all fulfilment operations. Essentially, you store your products at 3PL warehouses and when you get an order, they pick the products from the shelves, pack them and ship them to the end customer. As a result, 3PL logistics warehouses need much more automation and modernisation than traditional warehousing in India.

Growth of Tier-II Markets like Indore

Indore, a Tier-II city in MP, is growing its share of ecommerce and as a result, growing its share in the warehousing space also. As the Tier-II markets get more digitised, their share of ecommerce and modern warehousing will continue to grow.

Cold Chain Warehousing

How do Licious and Fresh to Home bring you fresh fish? Somewhere along the value chain of catching the fish to delivering it, they had to use cold storage to ensure that the fish doesn’t go bad. Business models like Licious, Fresh to Home, Epigamia, Pharmaceuticals and others are driving the growth of Cold Chain Warehousing which requires temperature-controlled storage and distribution. The cold storage market remains an unorganized and fragmented play in the country - we’ll cover cold storage in more detail in the future.

India does not have enough Warehousing Space

Warehousing is a key piece of infrastructure. Without it, businesses cannot function effectively and India just does not have even close to the levels of warehouses as developed and developing countries. If you’re bullish on the India growth story (we are), warehousing will continue to grow alongside.

Players in the Warehousing Market

Regulator

Warehousing Development and Regulatory Authority (WDRA) under the Department of Food and Public Distribution.

The WDRA was formed as per the Warehousing (Development and Regulation) Act, 2007 which is the current governing act for warehousing in India.

Physical Infrastructure

On the physical infrastructure side, we have:

Active Developers - actively participate in developing new warehousing infrastructure.

Passive Players who bring in capital and global know-how and manage their relationships with local partners.

Physical players:

Indospace - active developers backed by Everstone, GLP, and CPPIB - raised at least $1.5 billion.

Blackstone - passive player - one of the biggest money managers in the world.

Arya Collective Warehousing Services - raised $113 million - provides post-harvest services. Another big use case of warehousing for farmers.

Dozens of big and small players on the physical infrastructure side of warehousing.

Cloud Warehousing

WareIQ - raised $1.8 million - Warehousing for D2C brands - stores inventory closer to your demand, allowing for quick delivery.

Wherehouse.io - seed funding from Better Capital - Convert existing unused storage capacity into micro warehouses (e-commerce ready warehouses) for same day/next day delivery for D2C brands.

BoxMySpace - raised $3.2 million - On-demand warehousing & Home Storage.

Goldfishh

Warehouse Robotics

GreyOrange - raised $183 million - building robots for Warehouse Automation, primarily for US & European customers. Really futuristic products.

ArkRobot - raised $350k - building robots for Warehouse Automation, more focused on the Indian market.

Unbox Robotics - Raised $8 million - building a parcel sorting robotic system

Technology & Warehouse Management Systems (WMS)

Increff - raised $16 million - Warehouse Management System + Cloud Warehousing

Zoho Inventory

Orderhive - acquired for an undisclosed amount.

Know other IT products for warehousing made in India? Let us know and we’ll add it here.

Others

Edgistify - raised $879K - a network of 52,000+ warehouses with 3PL-like services.

The entire 3PL industry - warehousing is a key part of 3rd Party Logistics. 3PL probably deserves a newsletter of its own.

Warehousing Challenges in India

Finding Real Estate in congested Indian cities.

Scalability as brands grow - building new warehousing takes time.

Rising prices of steel. Steel accounts for about 30%-40% of the overall construction cost.

Warehouses in India cannot be fully automated - therefore, you need to be able to hire skilled manpower from neighbouring villages since the majority of warehouses will be in rural areas.

Fractionalisation of warehousing cannot not happen in India because of the high fixed costs of technology & automation. You will need economies of scale to be able to justify the cost of automation even if you already own the land/building.

No standard definition categorising warehouses into grades such as A, B or C. For example, getting star ratings for Hotels (i.e. 5 Star) has a standard definition which customers can trust. However, this does not exist for warehousing. The marketing tells us that Grade-A warehouses facilitate efficient operation thus leading to the lowest Total Cost of Ownership (TOC) for the development. But, what are the requirements to get this Grade?

Warehouse Opportunities

Warehouse Building Products & Services

As other people are building warehouses, you can literally supply the picks and shovels. For example, Sahil supplies Lightning Protection & Earthing products for projects including warehouses. Not necessarily a sexy business but traditional Dhanda.

Build a Warehouse Marketplace with Grading

A few warehouse marketplaces already exist - Arya Collective for farming, Edgistify and others. However, there are 2 problems that still need to be solved:

Standardised rating of warehouses by a Neutral 3rd Party

Local Search for Warehousing Space

Marketplaces are always tough businesses to build. A bootstrapped version of this could simply start as a technology-enabled broker for a region that uses a grading rubrik to help classify warehouses.

Build Grade A Warehouses

Leased warehousing space developed into Grade A warehousing spaces. In the absence of ready-to-lease Grade-A assets, giants like Amazon and Flipkart are waiting for warehouses to be built and opting for built-to-suit transactions.

Build Warehouses in Tier-2 Cities

Around 60% of modern warehousing capacity in India is concentrated in the top eight cities of Delhi-NCR, Mumbai, Bengaluru, Chennai, Pune, Kolkata, Hyderabad, and Ahmedabad. Experts, however, say there are new pockets of demand emerging in tier-II cities

Convert Old Spaces into Standardised Warehouses

Old industrial units, large banquet halls, single-screen theatres, or malls that have been closed for many years. These spaces can be converted into warehouses. Standardisation of processes, IT infrastructure and gradation can allow customers to pick the quality of warehouses they need.

Demand would be especially high in Tier 1 metros where warehousing is limited BUT important for last mile delivery. This would be a funding intensive venture requiring capital to buy properties upfront and/or to refurbish them.

Build Technology and/or Robotics for Warehousing Automation

The most basic technology are the IT systems and Warehousing Management Systems to help automate the basic functions of warehouses. Increff, Orderhive and other international brands have shown a clear need by warehouse customers for high quality Warehouse Management Systems. These help to make the entire warehouse operations much more efficient. You can niche down to specific industries or types of warehouses that have a particular need not being solved by current generic warehouse solutions.

Warehouse Robotics have received some of the most funding globally. Extremely technical field that would require lots of funding to build, nevertheless at exciting field. Here’s a detailed look at the current state of warehouse robotics.

Other Opportunities

Acquiring land in India is tough. Global funds cannot handle it because they have global compliance issues. Leaving that to local developers is a more viable option.

Warehouse Financing for the goods kept in the warehouses. Arya Collective is

Trucking and Warehousing - Setting up an end to end storage and delivery service for the growing e-commerce space in India

Further Reading

Understanding the different types of warehouses you can build

India Warehousing Show 2022, 19-20-21 August, 2022 - exhibitions are great places to learn about new industries

That’s it from us this week! Share this with your friends, family and colleagues who want to stay on top of Market Trends and Business Ideas & Opportunities!

Until next week!

Sahil & Sid