This week, we explore the trend of Electric Vehicles (EV) in India and the opportunity of building an EV focused business.

Have you ever been inside a Tesla?

I sat in a friend’s Model S for the first time last year and was stunned. I’m not even a car-guy but as soon as I sat in the car, I understood why everybody was so enthralled by Tesla and why it is leading the global wave of ‘New Mobility’ in the public’s mind.

So, when we decided to write a newsletter about Electric Vehicles, the first person we reached out to was Sachin Seth, “Finance manager for Tesla's flagship products - Models S and X, Finance manager for Tesla's upcoming China factory” and much much more. Sachin has a fantastic newsletter called ‘Car Talk’ where I first learnt about the term ‘New Mobility’ - check it out! We took a deep dive with Sachin on all the new mobility technologies and their current state of play.

This is our most ambitious newsletter to date - the New Mobility market has many different components. ‘CASE’ is an easy abbreviation to remember the components of New Mobility:

Connected

Autonomous/Automated

Shared

Electric

Every point above could be a newsletter in its own and I encourage you to explore them. Shared is probably what you’re most familiar with (think Uber & Ola), and its also the most mature market.

🧐 Market Gap

Climate Change is real and Road Transport contributes to 10% of Global greenhouse gas emissions (2014 numbers).

EV Battery prices have been falling steadily with average battery prices at $156 Per kWh In 2019.

“The average was over $1,100/kWh in 2010, and it should be around $100/kWh by 2023”.

Bharat VI standards have increased the price of Internal Combustion Engine (ICE) Vehicles bringing them closer in cost to EV’s.

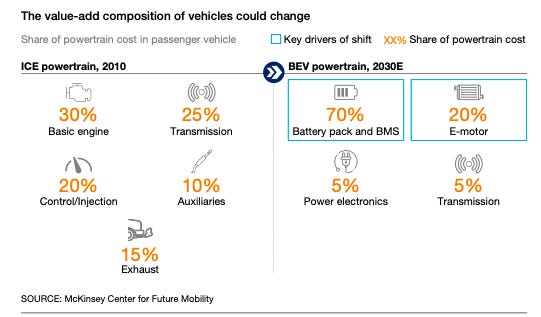

Batteries are about 40-50% of the cost of the car and the battery pack will make up about 70% of the share of the powertrain cost for EV.

The Government’s National Electric Mobility Mission Plan which includes the Faster Adoption and Manufacture of (Hybrid and) Electric Vehicles (FAME) Scheme.

FAME is now in Phase II with a budget of ₹10,000 crore till 2022. Its main thrust is to accelerate localisation of EV manufacturing through subsidies for vehicles that meet its criteria.

Click here to find the latest documents on eligibility criteria and the timeline for indigenisation of production. This article lays out the subsidies one can expect for a FAME II eligible vehicle - Rs. 20,000 per e-scooter and Rs. 1.5 lakh for a car.

Charging Infrastructure is also a focus under FAME II with the Minister of Heavy Industries stating that he wants to see at least one Fast Charger in a 4km x 4km grid of every major city in India. However, there are many challenges that lie ahead. The government is also in the process of building charging infrastructure on the highway network.

The government has a target of 30% EV adoption by 2030 but charging infrastructure remains the largest hurdle.

Air Pollution in India is some of the worst in the world - just look outside your window if you don’t believe me.

The Taj Mahal is turning yellow.

Air Pollution in Delhi is so bad that researchers recommend that, “(i)f you have the option to live elsewhere, you should not raise children in Delhi”.

Air Pollution in India is not solely caused by vehicular emissions but they are a contributor.

Our interaction with mobility is changing quickly because of new technologies. EV’s of the future will have in built autonomous, connected, and maybe even shared features.

Autonomous is being driven by improvements in AI/ML and being tested extensively. Think Autopilot in Tesla.

Connected cars are being driven by the IOT boom - there’s no reason your car can’t be connected to the internet and interact with other devices.

💰 Market Size

The entire automative industry, currently sized at ~$118 billion annualy, is poised to be replaced by EV over the next two decades.

🥊 Players

I’m going to focus on Indian players only - still an extremely diverse set.

Let’s break it up into 4 silos:

Vehicles

Batteries

Charging Infrastructure

Services

Vehicles

Society of Manufactuers of Electric Vehicles Member List

2 Wheelers

Ola Electric - The world’s largest Electric 2 Wheeler factory under construction

3 Wheelers

Bajaj RE EV - not launched yet.

4 Wheelers

The makers of India’s first mass produced Electric car, Reva.

Tata - Nexon EV, Tigor EV, Altroz, Nano Electric

Mahindra - eKUV 100, E Verito and e2o Plus

Maruti Wagon R EV

Buses

Olectra with Technology from BYD

They’ve gotten electric bus orders from across the country but their share price isn’t doing so well.

Batteries

India’s biggest import at the moment is petroleum products. When we shift to EV, this import bill will reduce right? Probably not.

India’s current Lithium Ion battery production capacity is almost non-existant and if we move to EV too fast, our petrol import will move to battery imports from China.

This article provides an in-depth review of the current state of Lithium-ion battery manufacturing in India and the government incentives to build capacity.

There are several startups working on Battery technologies in India.

Charging Infrastructure

A Guide to EV Charging & EV Standards in India

Manufacturer

Delta Electronics

ABB

Charging Network

Services

Cloud technology company focused on the automotive industry.

All Electric Taxi Company.

Also building charging infrastructure.

🙏 Our Predictions

EV Adoption will accelerate.

The cost of batteries will keep dropping to a point where the total cost of ownership (TCO) for EVs will be less than ICE vehicles.

Government regulations, incentives and subsidies will push businesses and consumers towards EV adoption.

Charging infrastructure will be built and people will feel more comfortable buying an EV.

Auto Components and spare parts manufacturing will be deeply impacted.

Auto component requirements will change as seen in the image below.

Electric Vehicles require less maintenance, reducing spare parts and replacement revenue - a huge market right now.

2W will lead EV adoption, the government is working on plans to require all two-wheelers to be electric by 2026.

Charging Infrastructure is a classic chicken or egg problem and thus there will be a lot of business model experimentation for this market.

Pay per use? By the minute or by power used (KWh)?

Subscription? Here’s an example from Gurgaon.

Advertisements at the charging pump?

Give away at cost but earn from complementary services or products?

Battery Swapping? Sell cars without batteries at a lower cost and lease swappable batteries to customers?

Electrical safety at home will become increasingly important as people start drawing more electricity for charging.

People will want to make sure that their inconsistent electricity does not affect their shiny new car.

Vehicles will be the new software platforms (like iOS and Android right now).

Cars of the future will be much more software enabled and dependant.

Electrical Utilities will have to change.

They are going to face many problems, especially Peak Demand problems. You can read more here. And here.

This will force utilities to collect more data on their customers so that they can predict usage patterns and adjust accordingly.

🛒 Opportunities

Battery manufacturing is dependent on Chinese rare earth elements.

Develop batteries that are not dependant on Chinese rare earth elements.

Build Infrastructure

Charging Stations

Service Stations

Last Mile Distribution (Dealerships)

Innovate on Financing.

The cost to purchase an Electric Vehicle outright is always going to be higher than a combustion vehicle because the fuel costs (battery in case of EV) is loaded up front in case of EV versus distributed over the lifetime for ICE.

This will result in innovative financing models, especially for commercial EVs, to ensure that the cost to own the vehicle can be matched with the cash flows that are generated by commercial EVs.

Listen to the Podcast with Altigreen to know more about this.

Read this newsletter by Sachin Seth for another detailed idea on financing.

Manufacture components and spare parts needed for EVs.

FAME II is pushing localisation but firms are complaining that this localisation is happening too fast.

There is enough space for an Indian manufacturer to enter.

For example, I randomly called an EV start up for this and they actually entertained me and sent me an NDA.

Consult traditional manufacturers on how they can manufacture for EV.

Scrapping of ICE Vehicles that are forced out of the market.

An ugly but necessary business.

Build a supply chain for batteries that can no longer power vehicles but can be used in other applications.

Build apps for EV platforms.

When the iPhone launched, it had only Apple Apps. They allowed 3rd Party Apps only a few years down the line.

Right now, Tesla and other manufacturers have giant screens in the front of their cars which are still closed or limited environments.

Maybe the future of all the White Hat Jr. students?

Provide data analytics for utilities and charging infrastructure providers.

Elocity helps DISCOMs tie the EV charging infrastructure directly into their own digital infrastructure.

Build a service/product based model around electrical safety for EV charging at home.

This is an area where I already work, let me know if any of you want to chat about this.

🧐 Looking to explore this market?

You can drop us an email and we’ll do our best to connect you to relevant people.

📉 Challenges

The EV industry in India has a lot of challenges that it faces but it has a bright future that I would bet money on.