Content creation needs content consumption.

But there’s too much content on the internet.

This week, we’re giving you 5 Amazing Long Form articles that will force you to think.

Indus Valley Annual Report 2022 by Blume Ventures

A 100 page document detailing the current state of the Indian startup ecosystem and the opportunities that lie ahead.

If you’re thinking of starting up, investing or just interested to learn about the landscape, Sajith and Amit have put togethere a fantastic data-driven document.

Lessons from 140+ Angel Investments

After reading the Indus Valley Annual Report, all of us want to do some angel investing but most of us don’t know how.

Over the past 5 years, Lenny angel invested in over 140 companies. 12 have grown into unicorns and 10 more are on track to get there this year. AngelList shared that Lenny was in the top 20 investors on their platform.

It’s safe to say that Lenny has loads of lessons for us about Angel Investing. What are those lessons?

It’s tough to spot which investments will do Best - If you see something special about the startup, and there’s a path to a 100x exit, consider investing even if you don’t have full conviction.

Most deal flow comes from other investors - Increase your deal flow by building relationships with other active investors.

Great deals are currency among investors - Seek out three to five awesome angel-investor friends and share everything you see with them.

Angel investing is more about access than picking - Work on building your ability to get into hot deals, and don’t stress out about not being able to pick, especially early on.

Be someone founders want as an investor - Best way to grow deal access is being someone founders want on their cap table by having a skill founders like (distribution, growth, intros etc).

Have you made any angel investments? What were your biggest takeaways?

The Four Quadrants of Conformism by Paul Graham

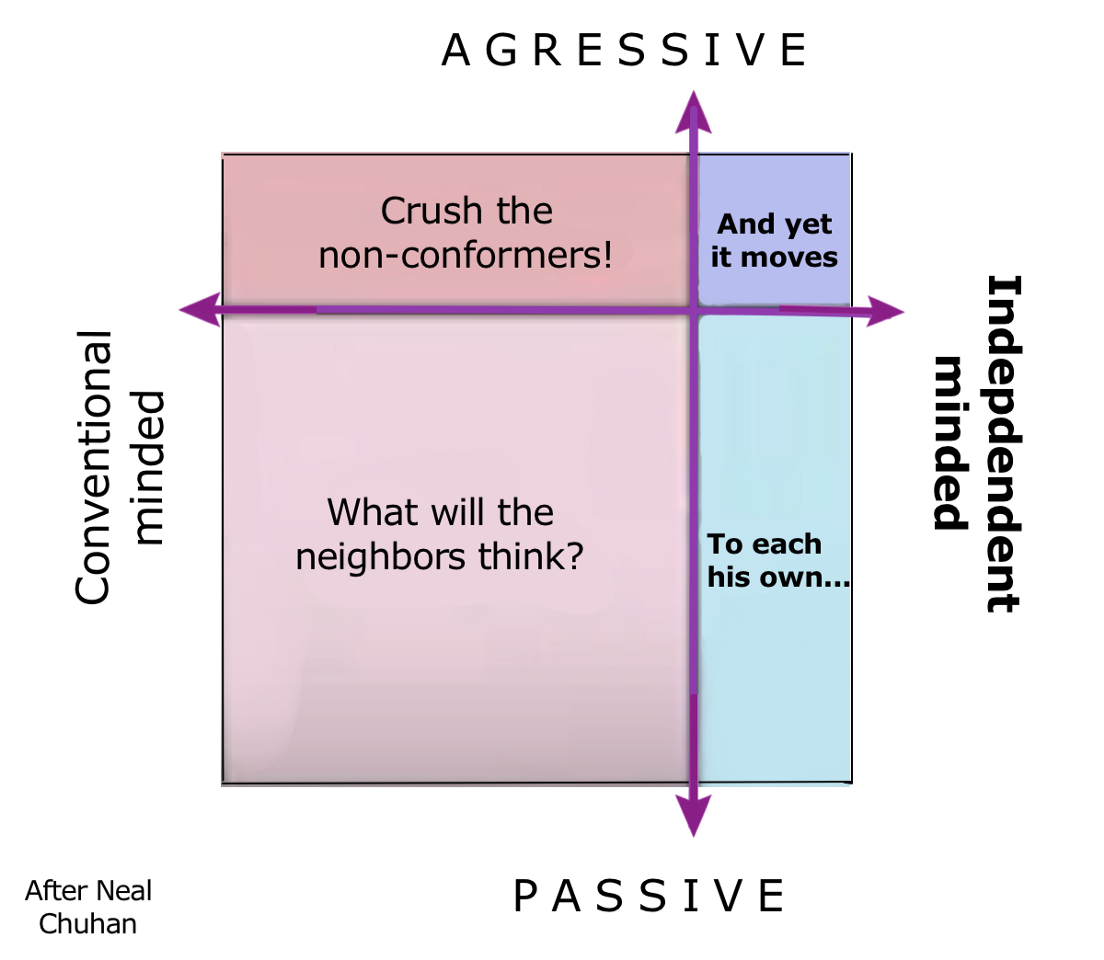

We love the framework that Paul Graham built around Conformism though don’t necessarily agree with the conclusions.

Essentially, he says that there are 4 types of people:

Passive Conventional - They're careful to obey the rules, but when others break them, their impulse is to worry that those people will be punished, not to ensure that they will. “What will society say if you do ___”

Aggressive Conventional - They believe not only that rules must be obeyed, but that those who disobey them must be punished. This is the conservative Twitter mob that wants to destroy anyone with thoughts outside the norm.

Passive Independant - They don't care much about rules and probably aren't 100% sure what the rules even are. “Let people do what they want”.

Aggressive Independant - When they see a rule, their first impulse is to question it. Merely being told what to do makes them inclined to do the opposite.

While Paul Graham applies this framework to the issue of Free Speech on the internet & other spaces, you can also apply this framework to your own friends, family & colleagues to understand their motivations.

Which quadrant do you fall into? What about your closest friends and family?

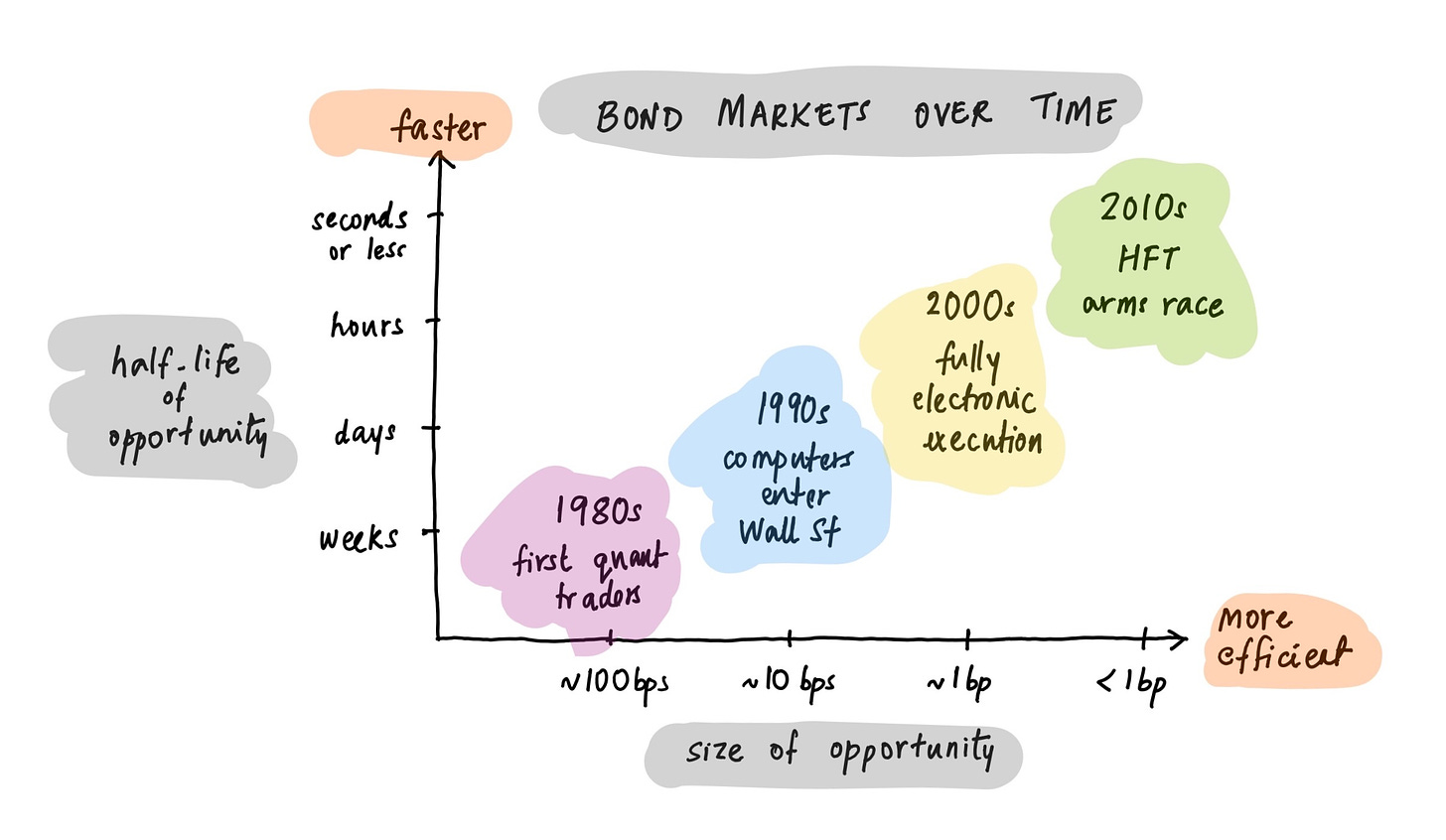

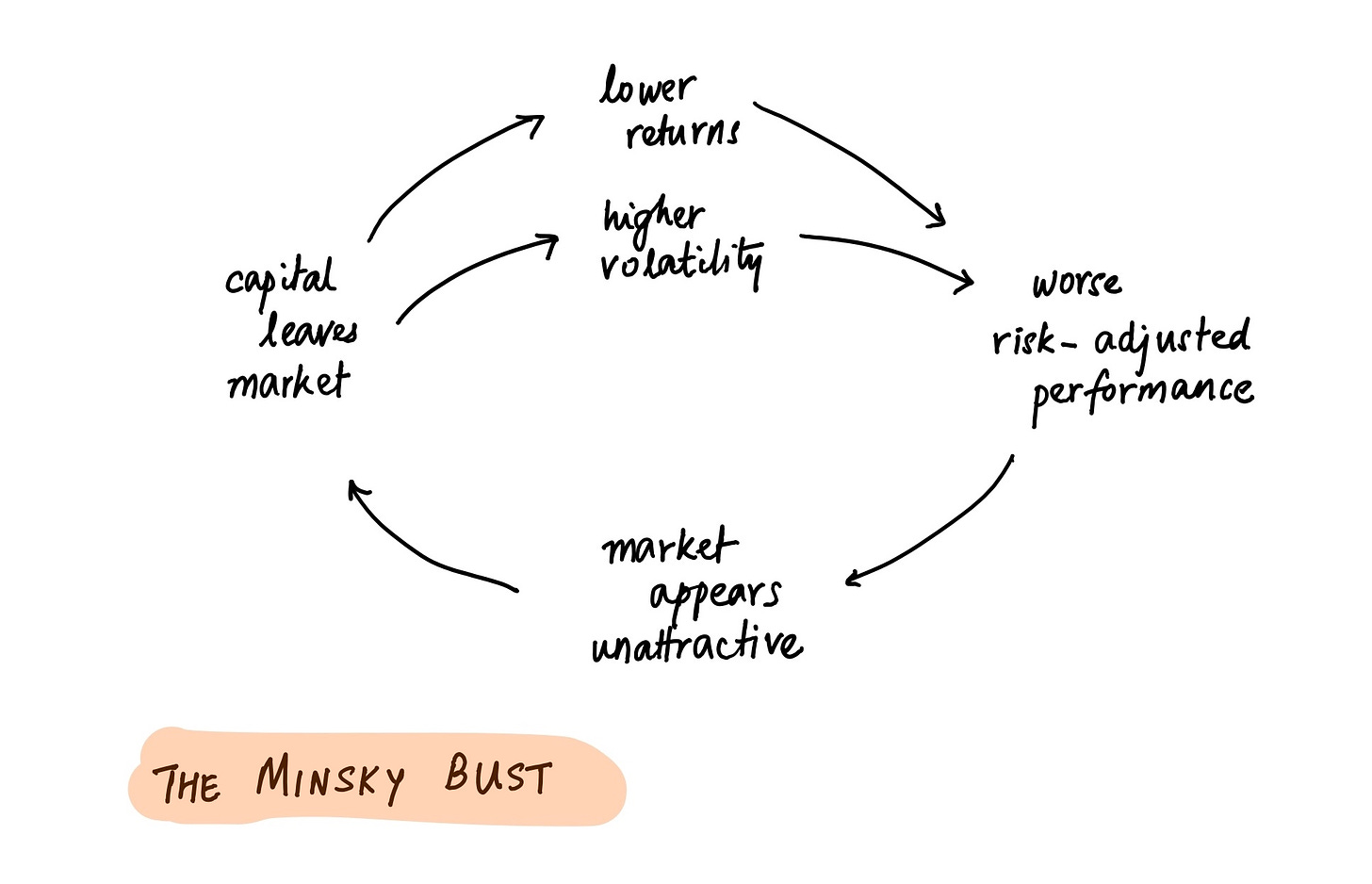

Minsky Moments in Venture Capital

Markets rise, and markets fall. This much is well-known. But why do market cycles occur? What causes the pendulum to swing from euphoria to crisis and back?

We’re currently in the midst of an unprecedented boom in private market activity. Tech entrepreneurship, angel investing, and venture capital have never been so widespread.

But why?

This article explores one possible reason - Minsky Cycles.

What is a Minsky Cycle?

A new asset class with 10x returns is discovered.

Lots of Capital enters that market.

Knowledge spreads, technology diffuses, and arbitrages disappear.

A slight selloff causes returns to drop and risk to rise.

Over-extended investors begin to trim their positions.

This raises the risk of the Asset Class → Banks and brokers require leveraged investors to post margins that are proportional to their new portfolio risk.

They have to sell assets to service these calls → creating further volatility and downward price pressure.

Seeing declining performance and increasing volatility, LPs in a fund request their money back

But will this happen in the Venture World? We’re seeing higher and higher valuations for startups - is this a Minsky Boom? Are we currently seeing the start of the Minsky Bust as startups IPO’s have fizzled out in the last few months.

The article is a brilliant exploration into these ideas and raises questions for all investors.

What do you think? Are we going to see the bust of Venture Capital this year?

Money: The Unit of Caring

This article is a great example of bad writing. It presents a great idea that’s packaged badly.

The basic idea is that we shouldn't volunteer our time for charitable pursuits we find worthy - in fact money is a much better substitute. As someone with an MSc in Economics, I agree.

Donating money will have a larger impact than donating time because we are not specialised for these tasks. For example, a CEO is not a specialised beach cleaner but they are specialised at building organisations. The can use their time and money to build processes and hire people who can do a much better job than the CEO.

We sent this article to a few friends who volunteer a lot of time to charitable organisations. They had 2 very different but insightful responses:

What this articles doesn’t talk about are the learnings and realisations we have when we are doing such work, the depth of these learnings help connect dots which are very futuristic. I was involved in environment issues for 12 years. For the first 9 years I didn’t think of business around it, I was only passionate about the issue. Now it’s the core of what we do and thanks to the depth of understanding we are much a head of the curve for now.

In fact same is the point with mentoring, I love mentoring startups and it is something which didn’t give me any money but did help me learn. Now those learnings help me create large businesses. It’s only in the last 2 years I invested very small amounts and with coupled with mentoring within that also opens a higher upside.

The second response:

The mind is like a monkey. One can convince it whichever way one wants, and build rational logic accordingly.

What this article says makes sense only if we believe that impact is to be made outside. We can surely buy that outward impact.

But actually, the larger impact is made inside by working outside. We can't buy that ability to evolve. That's why Prince Buddha had to leave his kingdom!

It's not just about doing but being. 😊

What do you think? Can you make the world a better place with only money?

That’s it from us this week! Share this with your friends, family and colleagues who want to stay on top of Market Trends and Business Ideas & Opportunities!

Until next week!

Sahil & Sid