“It ain't no fun if the homies can't have none. ”

― Snoop Dogg

If you know someone who’d like our content, or if you just want to show off your knowledge on Twitter & LinkedIn, please share this article!

But First, Why did the News Break?

The movement of advertising money to the internet giants meant less money for news publishers.

Google, Facebook, and Amazon offer far more effective ways to target consumers.

The easiest way to regain revenue in the internet era was through Google AdSense and other ad networks.

Thus, these publishers optimised their content for clicks.

This eventually led to a vicious cycle where:

The news became more clickbaity -> more conversations on social media -> ad rates fell further -> Got even more clickbaity -> more conversions

This vicious cycle (or negative network effect) has played out over the last decade and left us with a Business News industry that is fundamentally broken.

What’s Wrong with Business News?

Opinions showcased as News

We often hear that "the pen is mightier than sword". Taking the metaphor further, a pen in the wrong hands is more devastating than the most vicious military general.

When opinions are presented in a newspaper, especially by those who can write well, it can influence people to take positions even counter to their own wellbeing.

Opinions ≠ Facts but opinions in the news are often intertwined with the facts without any clear distinction between the two.

These opinons don’t belong in news.

Take a look at the example below - half the piece is just the writer’s opinion.

Watch the 3 minute video below to see how narratives can be built based on a journalist’s or news organisation’s opinions.

Too much Negativity & Sensationalism

Sensationalism from written and visual media is designed to trigger emotions in the news consumer. This deviation from informing the reader to grabbing their attention at any cost is dangerous and has long-term implications from our perspective

Flashback to 2019:

I had just discovered a brand new Business News startup and couldn’t get enough. I was ecstatic that an Indian news portal was producing such high quality, heavily researched content.

Around the same time WeWork announced its IPO - I read everything I could find about the trainwreck for the next few months. Even my new favourite Business News startup wrote about WeWork’s failures.

I was an aspiring entrepreneur and thought I needed to know all the mistakes others were making. I would go to parties and talk about all the mistakes Adam Neumann made and the possible future of WeWork as if I’m some kind of Business Soothsayer.

I kept telling myself, “This is not gossip - this is learning.” I allowed the schadenfreude to take over me - I enjoyed watching succesful companies fail in public.

Eventually, I caught myself in this cycle of negativity - I could see that I was just waiting for the next article lambasting some popular startup. I unsubscribed from various newsletters, stopped reading about WeWork and focused on the positives of businesses around me. That’s when I realised that even business news often tends to skew negative because negative news sells. Kinda like Page 3 gossip but for business?

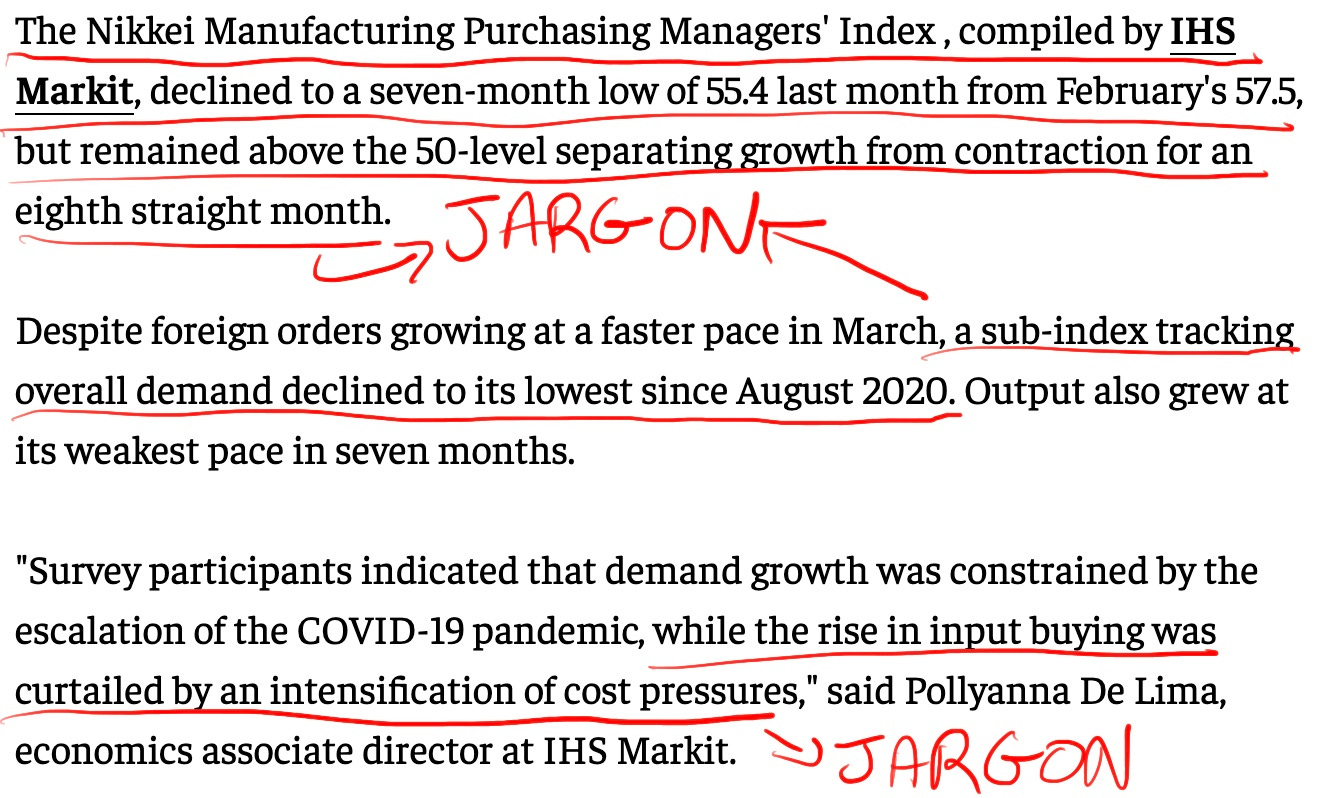

Too much Jargon

Traditional business news outlets like The Economic Times or Business Standard use financial jargon making it difficult for people outside the finance or banking industry to understand and parse through the language.

It’s unnecessarily complicated.

Clickbait-y Titles & Articles

Reliance on ad revenue has made the objectives of news companies change from informing you to keeping your attention long enough to serve ads. This is typically done through excessive notifications and alerts, endless scrolls, clickbait headlines, and gossipy content.

- The Boring News Co. again.

The incentive of free news is to get as many people to click on a link - hence the entire news is made to be clickable.

It’s not necessarily the truth, the facts or what you need to know - it’s just made to trigger the human brain to click on the link.

When that’s the incentive - you’re obviously not going to get the right information.

Individual Company Funding Events Don’t Matter.

“EdTech startup raised $300mn"

"9-year old startup folded after 6 rounds of fundraising"

"P2P Lending startup, increased their user-base by 10x after expanding to tier 2 cities"What value have you received from these headlines?

The actual articles don’t go into much more detail than those headline numbers. The way individual company funding events are presented in business news don’t add value to the reader.These funding events are usually written without any details on the VC’s investment thesis, market dynamics, etc. In these cases, we are looking back at past events, without any real impact on the reader’s future - it’s just clickbait.

Business media is OBSESSED with funding events - you can’t read any newspaper or modern newsletter without reading about some startup from Bengaluru who received $1 million in funding.

How can this “startup funding journalism” provide more value to the reader?

Focus on Volume instead of Depth

Another consequence of being dependent on link clicks is that media organisations are focused on writing as many articles as possible. Thus, journalists are pushed to focus on volume instead of depth.

Political Bias + Business News does not mix

A reporter’s bias towards a certain political party shouldn’t influence how they view a particular business. And they shouldn’t influence you with that bais either.

Political bias ends up skewing the actual analysis of business performance.

I want to give you an example but I don’t want to get sued.

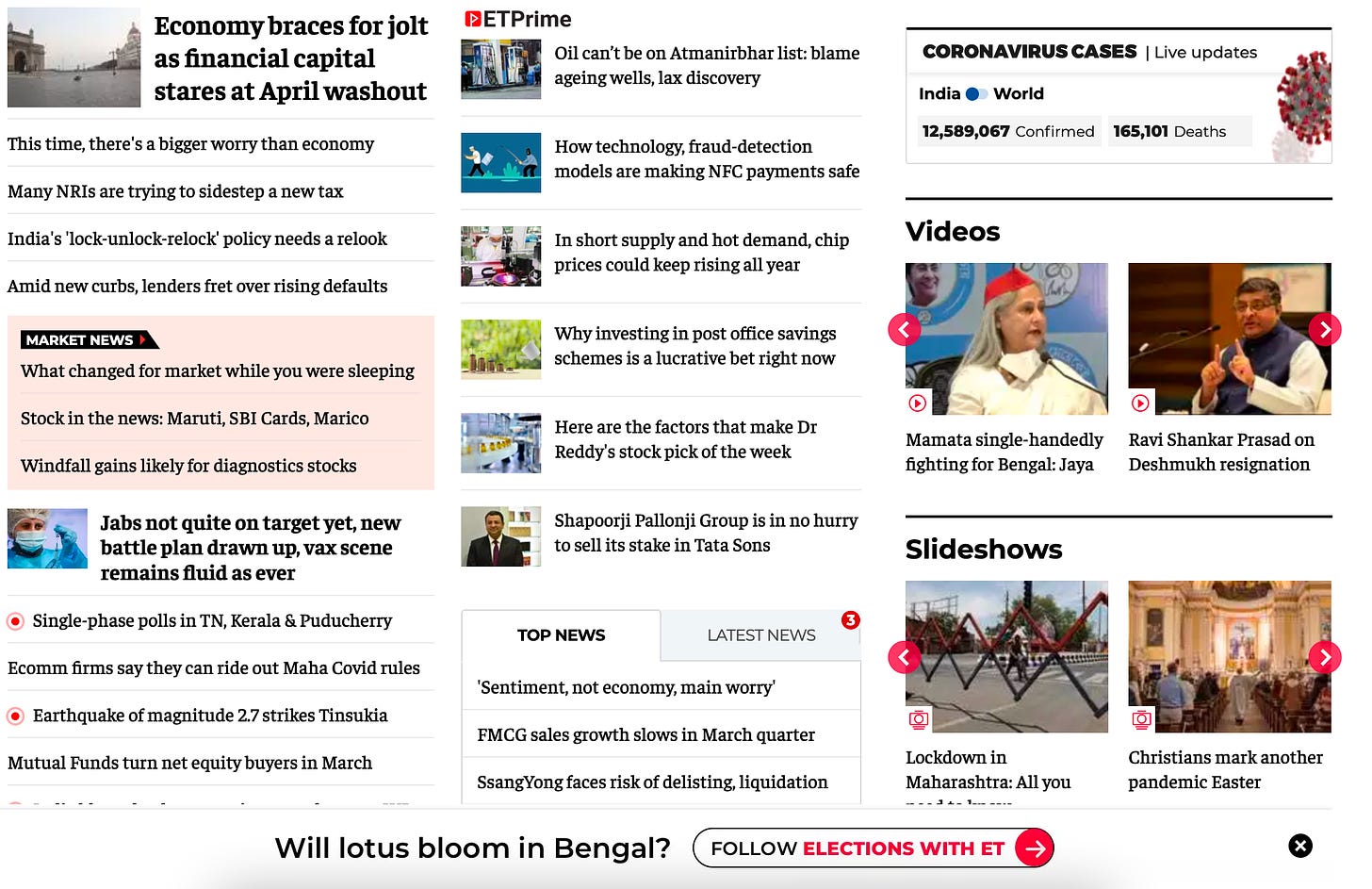

The online reading experience is not enjoyable or well designed

I’ve attached a screenshot of ‘The Economic Times’ homepage below - draw your own conclusions.

Not Relevant to the Average Reader

What’s happening to a 10,000 cr semi-conductor plant is not relevant to the average reader. How do you make it more relevant, relatable and value add?

Challenging the Old Guard

A number of new media businesses are popping up across the country challenging each piece of the broken business model. Some focus on the negativity caused by traditional news while others focus on reducing jargon and making news more accessible.

The Better India - Positive Journalism!

The colours on the website are vibrant and stories are positive - a healthy change of pace from the negativity of mainstream media.

The Better India also provides signficant coverage on solutions to environmental issues.

In fact, when we started reseaching about Seaweed Farming in India, the only article I could find was a super positive article from The Better India.

TBI has built a community around their positive journalism and launched a D2C brand called ‘The Better Home’ during the lockdown.

The Ken & The Morning Context - Bringing Depth to Business Journalism

The Ken is probably India’s largest paid newsletter with more than 35,000 paid subscribers. The Morning Context was started by the former Managing Editor (& co-founder) of The Ken.

They do only 1 article per day - usually 10-15 minutes reading time per article.

Saurabh Garg told us that journalists at The Ken spend two weeks researching each article.

The Ken and The Morning Context are both paid newsletters.

The Ken has received $2.1 million of funding and The Morning Context has also raised a Seed Round.

The Boring News Co. - Removing opinions & sensationalism from News.

Founded by a former investment banker, Sajal Khanter.

Sends a daily newsletter, takes only 3-5 minutes to read, simplified and stick to the facts.

Bullet point reporting - similar to the style used by Axios.

Currently at ~3.5k engaged readers.

Focused on millenials.

Not business focused but similar to the style Siddharth & I would have used if we ever started a daily newsletter.

Watch out for a Podcast we’ll be doing with Sajal in the near future.

Do you have any questions for Sajal? Join our No Spam WhatsApp group and let us know.

Filter Coffee - Making Business News Accessible to Gen Z

Founded by a young Law Student, Tanvi Dessai, as a Covid side hustle.

Sends a daily newsletter focused on Business News.

Simplified, uses GIF’s & memes to make the news more appealing to Gen Z audiences.

Similar format & writing style as The Morning Brew & The Hustle from the US.

Currently at ~8,500 subscribers.

Simplinations - Business Storytelling - ~10,000 subscribers I think?

Their article about Jio went viral in 2020.

How Would TID Build a Business Newsletter?

All the players mentioned above focus on solving only one or two problems at a time - they don’t try to be the jack of all trades. This provides enough opportunity for new entrants to position themselves with a solution that no one else is providing.

The biggest challenge in this business is the low barrier to entry - anyone can start a nwesletter. Do you have a large existing audience or bucketloads of money? If so, you might be able to carve a niche for yourself.

This is how we’d do it (if we had the time/money):

Target Demographic

20 - 45 year old founders, business owners & aspiring entrepreneurs.

Monthly Subscription

The subscription model will align incentives to provide the highest value to the customer.

~₹1,000/mo promising high quality, actionable insights direct to your inbox 3x a week.

No Bakwas - Business News focused on bringing value to the reader

On retainer experts (like CA’s, Lawyers, etc.) who provide the latest policy changes in GST, Production Linked Incentives, State level incentives, etc. in a format focusing on actionable insights.

How will this impact the reader? What do they need to do?

For example, I just received this complicated article from my CA with no explanation about its impact on my business.

What are the opportunities for SME businesses and how can they capitalise on it?

Cut out the Noise - follow only what matters to you

Choose the topics & industries which have the largest impact on your business (ex. manufacturing incentives) and only receive updates on them.

Funding News with Market Analysis

Funding news in a vacuum is just clickbait - it needs context!

Funding news along with a market analysis and investment thesis (like what we do with Trends right now) providing readers with the insights to build or invest in businesses in the same space.

Explaining Weekly Forex, Commidity, Crypto Trends

Unless you’re a savant for memorising numbers, trends will be a much bigger value add for you than just daily ticker numbers.

Analysis of forex & commodity trends (maybe a functionality to specify your requirements?) will give you actionable insights.

On an early episode, Akhilesh told us how he saved an entire year’s profit by closely watching plastic prices crash in 2008 and making the right bet at the right time.

Crypto because it’s 2021.

Tying Together Education & News

Our goal at The Indian Dream is to provide the tools to entrepreneurs to build profitable & long lasting businesses. We’d love to find a way to integrate long lasting business & finance education into the news cycle.

Isn’t learning the whole point of reading the news?