Sula Wines🍷 - Business Breakdown

Deep Dive into Sula Wines' Financials to understand their Business Model

Hey Everyone!

Apologies for the lack of emails for the past few months - we’ve been more focused on growing our social media right now. Subscribe to our YouTube in case you don’t.

Sula Wines recently announced that they’re coming out with an IPO and subsequently filed its Draft Red Herring Prospectus on the SEBI website. We read through all 460 pages of the SEBI fillings to find all of Sula Wines business secrets. This newsletter is a complete breakdown of the Sula Wines business through their financials.

Disclaimer: We are not financial advisors and cannot advice you on whether or not to invest into Sula Wine’s IPO. Our sole purpose with this article was to figure out how Sula runs its operations and how it has managed to differentiate itself from the rest of the market. Do your own research before applying for any IPO.

Here’s this entire article as a video if you’d prefer to watch it instead.

Wine Industry of India

You can listen to our detailed podcast episode on the Wine Industry of India.

Important points to note:

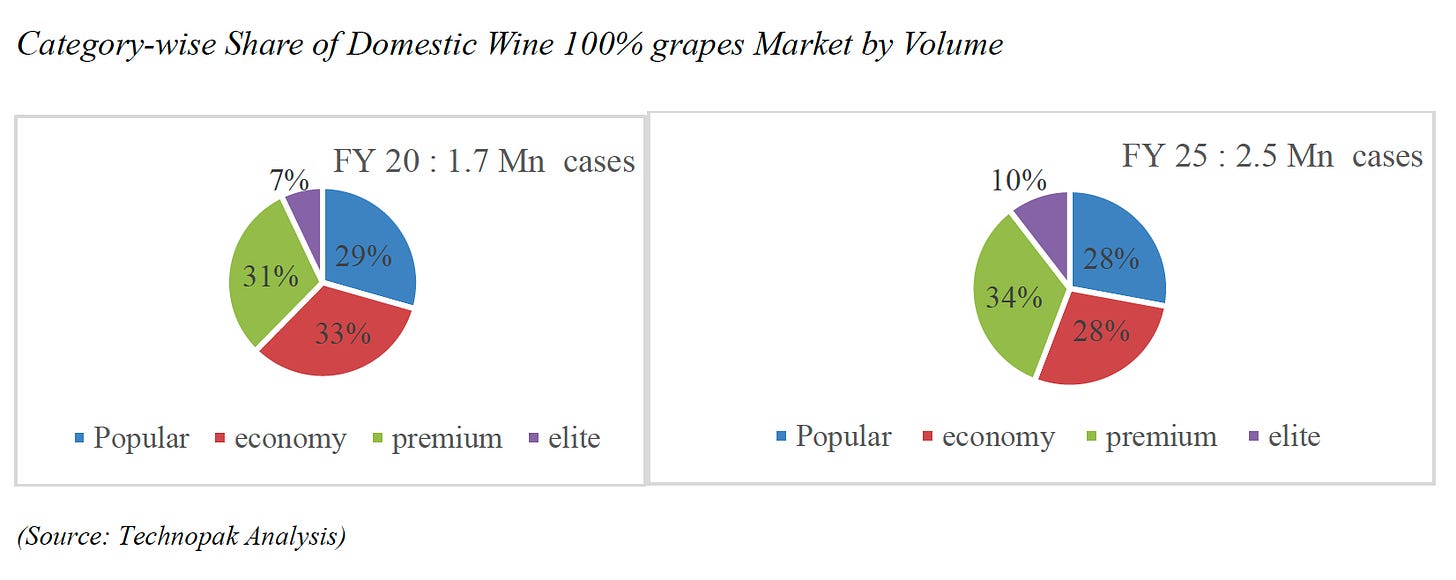

Domestically Produced Wine is ~₹1,200 crores market - with imports adding ~₹300 crores.

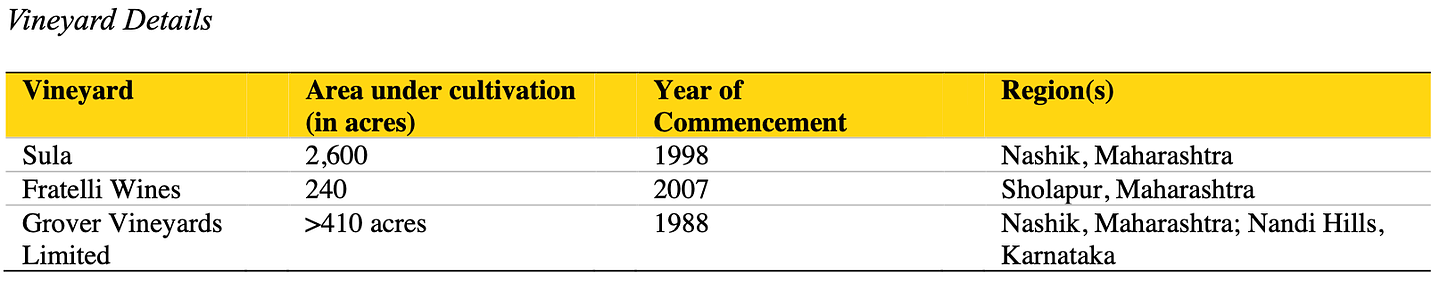

Sula, Grover & Fratelli control 80% of the Wine Market.

Sula controls ~50% of the Wine Market.

Maharashtra and Karnataka produce 97% of Wine Grapes in India because of Policies. Maharashtra itself produces 90% of Wine Grapes.

Wine Incentive Promotion Subsidy ('WIPS') scheme launched by the state of Maharashtra is the main reason behind this concentration. Under the scheme, VAT paid by Sula Wines on wine manufactured from grapes produced in Maharashtra and subsequently sold in Maharashtra is eligible for 80% refund. As a result, ~50% of Sula Wines’ sales are also from Western India.

Sula Wines Business Breakdown

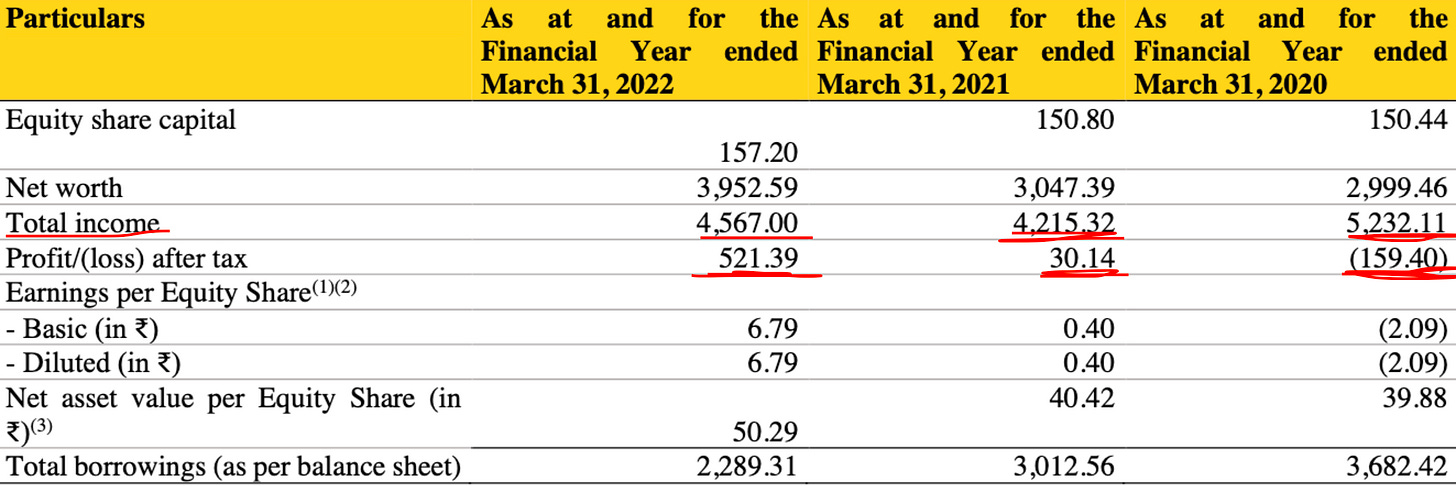

Let’s start with a sneak-peek at their Financial Summary. Remember, all these numbers are in Ruppees Millions and ₹1,000 millions is ₹100 crores. Therefore, Sula Wines’ Revenues in FY22 were ₹456 Crores.

The Indian Dream podcast has always been about answering the question - how can we build a business like this? We started by interviewing founders and asking them that question - How did you build this business?

But the financials of a company can also tell you this story.

We spent 10+ hours reading through the 460 pages of the Sula Wines Red Herring Prospectus and we’re going to use that information to piece together how exactly Sula Wines differentiates itself from its competitors and how someone can try to build a 2nd Sula.

We’re going to break this analysis into 4 pieces:

People - Who did they hire and how did they compensate their staff?

Capital - How much money did Sula use to build the business?

Working Capital - How much money do they need to run their day to day business?

Brand & Product Strategy - What are they planning in terms of Product & Marketing to differentiate from the crowd?

When we’re done with this story - you will be convinced that Sula is using the following Powers to build a powerful moat around the business to deliver extraordinary profits and value to its shareholders.

Process Power - Embedded company organisational model and activities which enable lower costs and/or superior product.

Brand Power - The durable attribution of higher value to an objectively identical offering that arises from historic information about the seller.

Scale Economies - A business in which per unit cost declines as production volume increases.

These Powers are derived from the excellent book, 7 Powers by Hamilton Helmer.

Sula’s Organisational Structure and Compensation

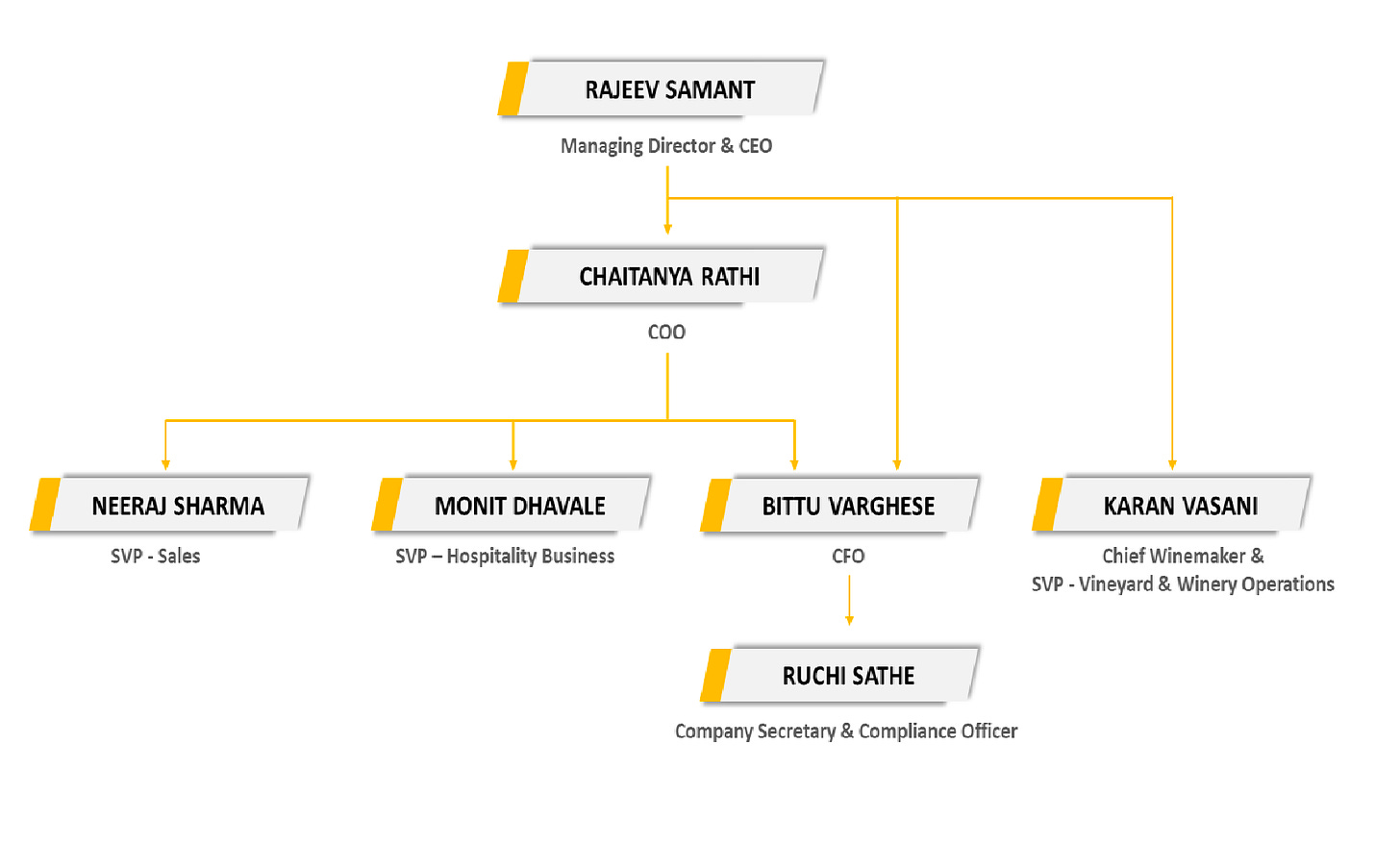

A quick look at the organisational structure before moving to the depths of the financials.

Sula Wines CEO and founder, Rajeev Samant is at the top and has only 2 people reporting directly to him.

Chaitanya Rathi - Chief Operating Officer

Karan Vasani - Chief Winemaker.

All the other Senior Vice Presidents, even the CFO, report to the COO.

Why is this important? Because the COO is handling the day to day work while Rajeev Samant is focused on what’s most important - Product & Strategy.

How much are Sula’s Top Employees Paid?

Sula pays their key employees generously.

Chaitanya Rathi (COO) - ₹2 crores + 0.64% ESOP - 9 yrs with Sula.

Karan Vasani (Chief Winemaker) - ₹59 lacs plus + 0.26% ESOP - 9 yrs with Sula.

Bittu Varghese (CFO) - ₹90 lacs + 0.12% ESOP - 3.5 yrs with Sula.

These are generous compensations for key employees in the company. ESOP is not used in traditional Indian businesses but Sula Wines is showing us that ESOP can be used effectively to retain top talent. This is how Sula can achieve Process Power - by having key talent in place for long enough time to build proper processes and structures.

Capital Invested into Sula

A fundamental question on our mind was:

How much money did they spend to buy & build the Assets at Sula?

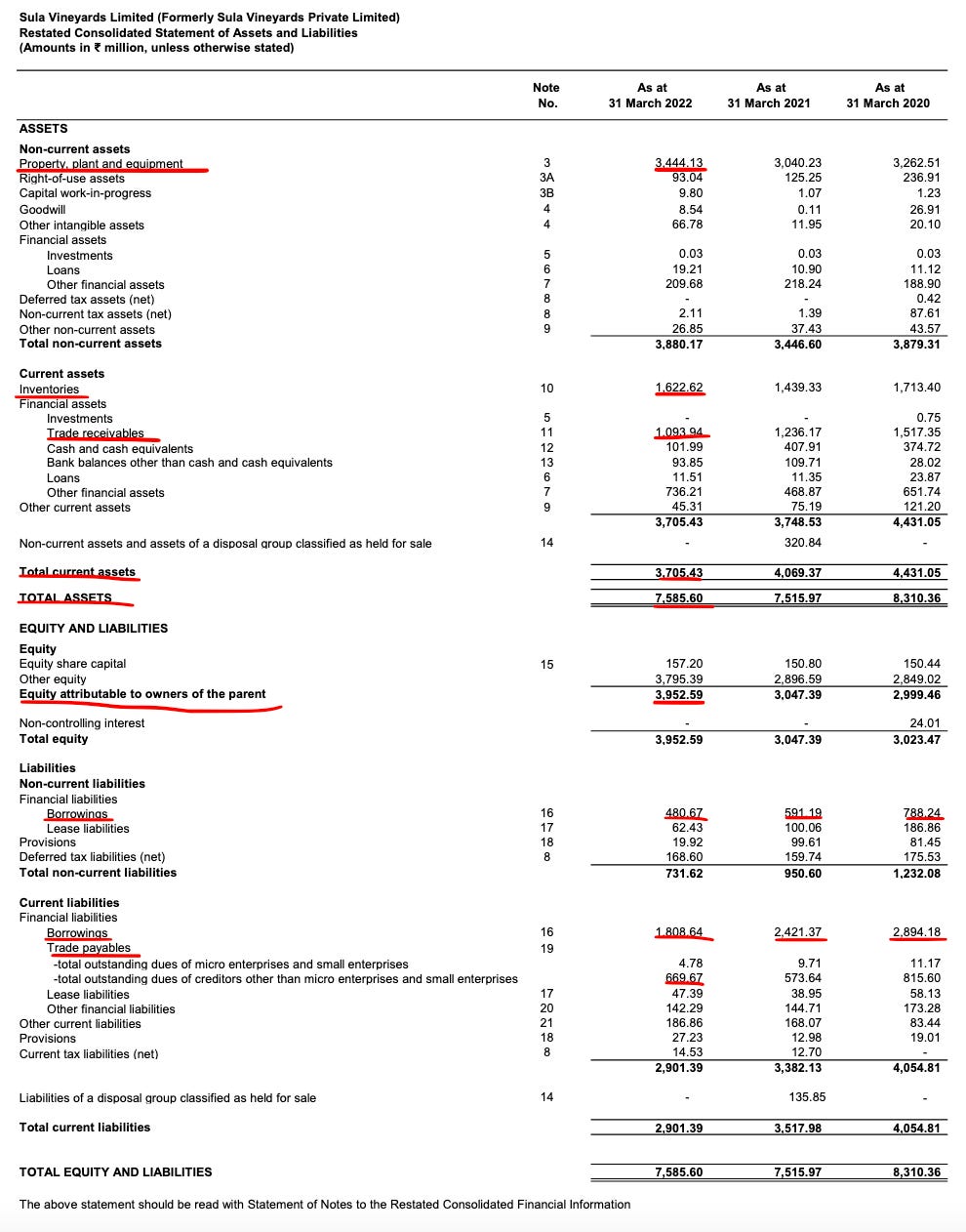

To find this information, we looked into their Balance Sheet and specifically under a line item called Property, Plant and Equipment (PPE).

The total amount they’ve spent on PPE over the past 24 years is ₹427 Crores and they invested an additional ₹55 crores into PPE in FY22.

The following are the full details of PPE - the red underlined numbers are before subtracting depreciation.

₹427 Crores to rebuild Sula’s infrastructures seems shockingly low. A VC backed startup could easily raise that much money and just copy Sula’s entire playbook and kick Sula Wines out of the market.

That’s because the ₹427 Crores number is wrong.

Sula is more than 24 years old and they’ve been buying/building assets for the past 24 years. The ₹427 crores is NOT THE PRESENT VALUE. For example, the ₹95 Crores of Freehold Land is how much they’ve paid to buy their 2,600 acres of land and NOT the present value of that land.

Therefore, if you had to re-make Sula - you’re going to have to pay a lot more to buy all of these capital goods. Probably 1000’s of crores just for the land. As a result, Sula’s landholding is 4x larger than its closest competitors combined!

Even if Grover and Fratelli bought that much land now, there’s just not enough demand in the market that can absorb such sudden growth from those brands.

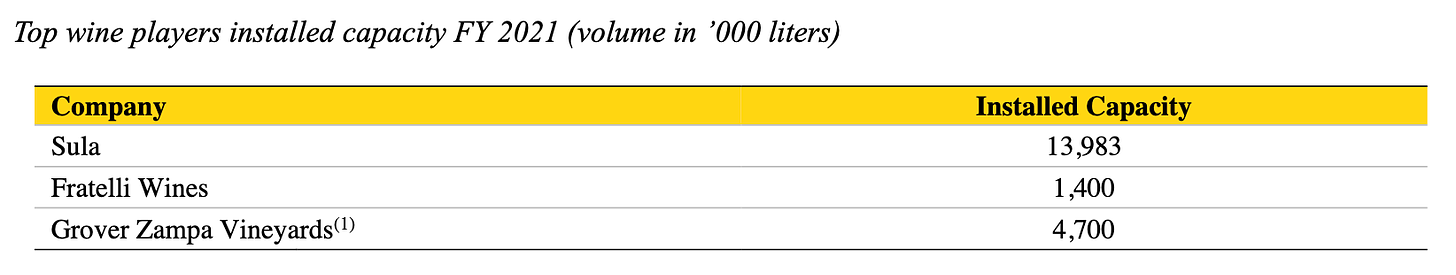

As a result, Sula has built an amazing moat around their production capabilities that no one can easily replicate. You can see these same dynamics play out in the installed capacity of all 3 wine manufactuers.

Using all this Data, we can surmise that Sula has been able to build scale economies which none of its competitors can match at the moment. We will discuss the impact on profitability at the end.

Long Term Borrowing

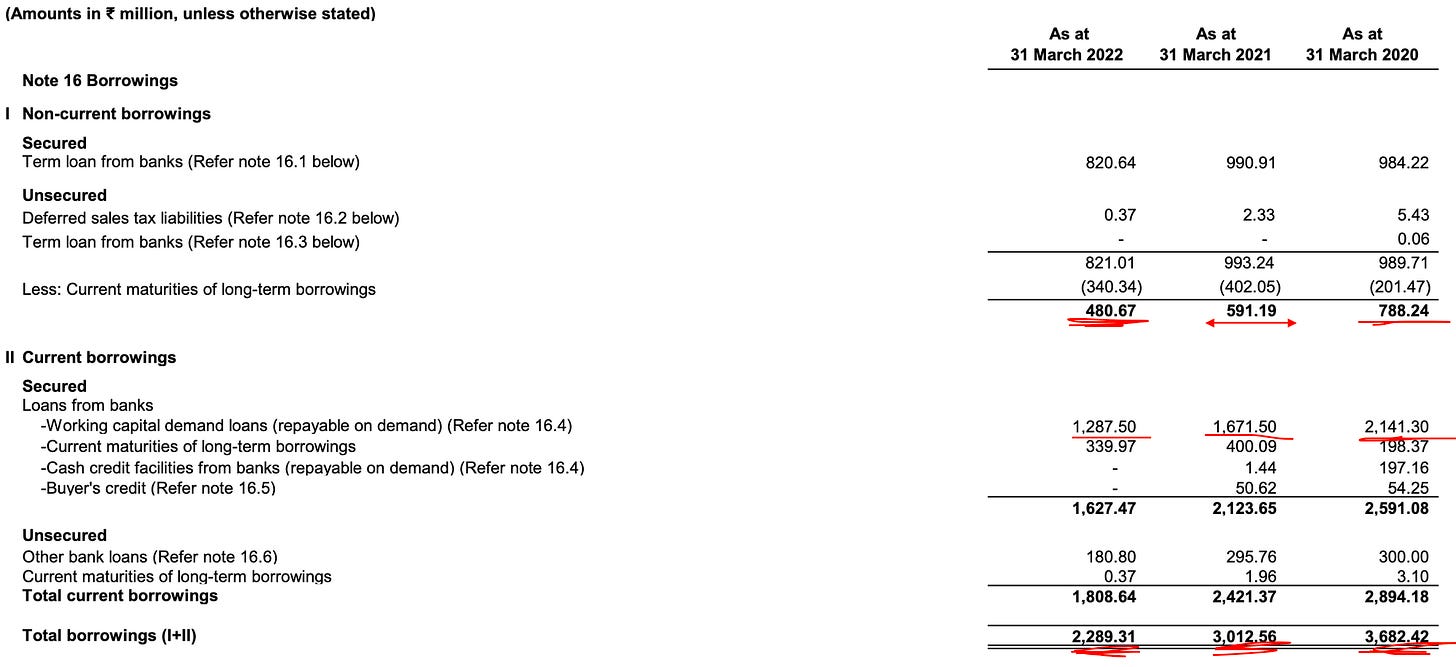

One question remains regarding Sula’s capital, how did Sula get the money to build so many assets? They did it through a combination of investments from the promoter & investors, accrued profits from many years, and borrowing from the bank.

In fact, in the last 2 years (possibly in preparation for the IPO), they’ve been focused on paying down their loans - they have reduced their long term loans from a total of 78 crores to 48 crores in just the last 2 years.

Loans can be risky - in fact, Sula was not making enough profits to cover the repayment of their debts (Debt Coverage Ratio was 0.96 in FY20 and 0.88 in FY21). But in FY22, they made 2x the amount of profits to cover their debts and are now in a much better position.

Working Capital

We expected the entire Working Capital Cycle for Sula to be a mess because of their inventory - they have to keep their product in the shelf for years at a stretch.

So we decided to check out their Cash Conversion Cycle - basically if you invest money into making wine right now, how many days will it take for your clients to pay you the money. This cycle is comprised of 3 main factors:

Inventory - the finished product, semi-finished product and the raw materials to make the wine.

Trade Payables - how much Sula owe to their suppliers.

Trade Receivables - how much Sula’s customers owe to them.

Typically you want your Inventory and Receivables to be as low as possible and you want your payables to be as high as possible so that you don’t involve as much of your own money in the process.

The Cash Conversion Cycle for Sula is 347 Days.

This means that it if Sula starts making wine today, it takes almost an entire year for Sula to get that money back from customers.

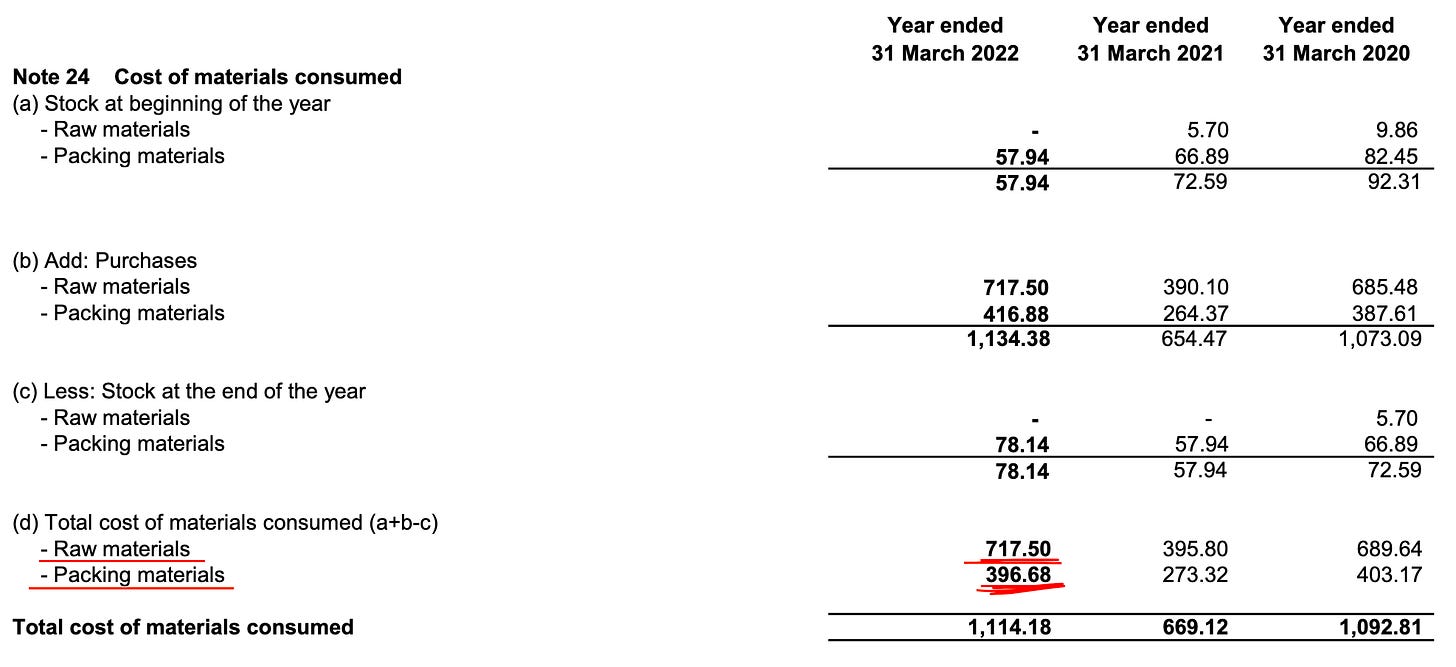

As a result, in order for Sula to make ₹450 Crores in revenue each year, they need to invest ~₹115 crores each year (this is the cost of raw material and packaging).

You can easily see this in the details of their Borrowing above because their Working Capital Borrowing was ₹128 crores in FY22. The reason they only need to invest ₹128 Crores of Working Capital to make₹ 450 crores in sales is because they have very high margins of ~70%.

But how does this compare to their competitors?

Sula is actually MUCH MORE EFFICIENT at the Cash Conversion Cycle than its competitors. Let’s look at inventory days for Sula vs. its competitors.

Strategy - How is Sula trying to Differentiate Itself?

In this section, we’re going to discuss 4 parts of Sula’s Strategy:

Focus away from Imports and Distribution Business and Focus on own brands

Focus on Retail and Restaurant Distribution

Investments in Alternative Marketing.

Growth of Wine Tourism Business.

Moving Away from Distributing Other Brands to Focus on Own Brands

One of the first things that confused us when we looked at Sula’s financials was the ₹16 crores loss they made in FY2020 - remember that this financial year was before Covid even started. But 2 years later in FY2022, even though the Delta Wave was part of this financial year, they made a huge profit of ₹51 crores.

What changed?

We did some digging and our assessment was that the biggest change was a reduction in imports and their distribution business. In FY20, Imports & Distribution was 32% of their business while in FY22 it was only 8.5% of their business. There was also a shift in the gross profit margins of the import business where it moved from only 30% to 50%. Therefore, they moved to higher gross margin products for their distribution business. For comparison, Sales of their own brand has gross profit margins of 65-75%.

Sula itself mentions in the prospectus that,

One of our main strategies is to continue focusing on our Own Brands over Third Party Brands that we import and distribute.

What is Sula’s Product Strategy?

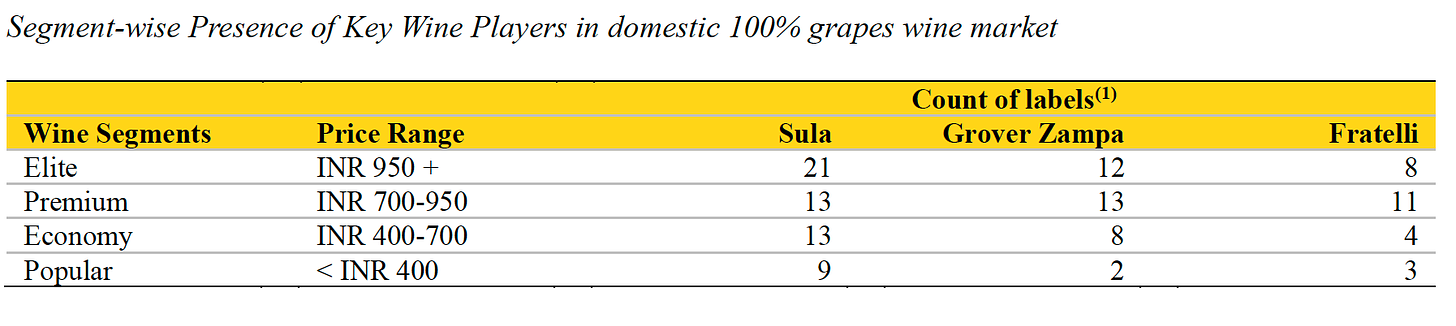

It’s quite simple - Sula wants one of their brands to be available at every price point that a customer is looking.

You can see below that Sula’s revenues are quite equally divided amongst the categories, except for the Elite Segment of Wine.

Sula is also not averse to acquiring other Wine Businesses to add to their portfolio. In FY22, they paid ₹17 Crores to acquire York Winery.

But one question remains, what Marketing Strategy is Sula using to promote its own brands?

Sula Wines should be available in every Restaurant & Wine Shop - Distibution

Sula mentions in their prospectus that customers first come across Sula Wines in a Restaurant or Hotel and then they go to a retail store to buy it.

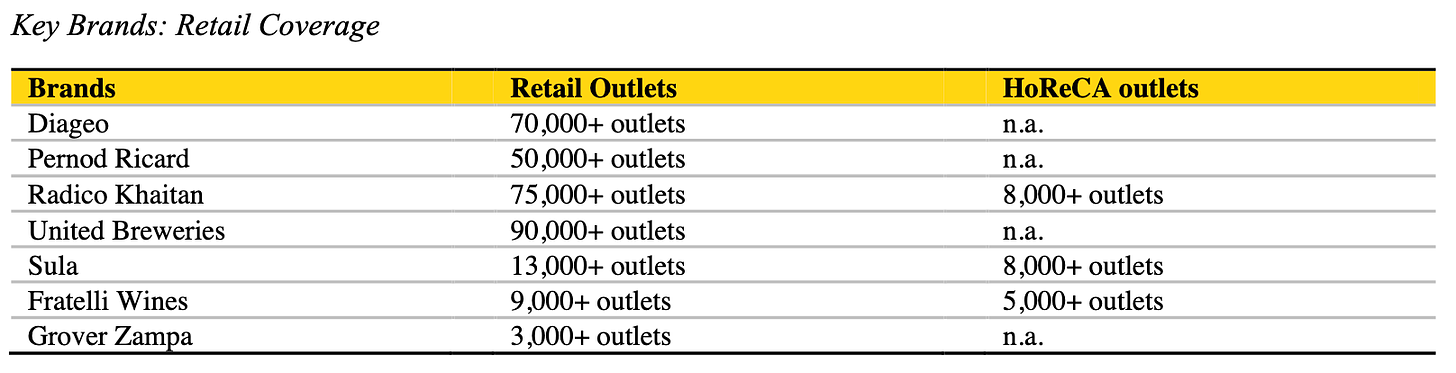

Therefore, they’ve focused heavily on building this distribution model. You can clearly see that Sula outperforms its rivals in this regard. However, Sula still has a long space for growth when compared to the Beer & Spirits businesses.

Investments in Alternative Marketing

As we discussed with the Fratelli founder, Mr. Sekhri, advertising in the Alcohol Market is difficult since direct advertising is illegal.

If you look at the Financials, you do see an investment in Marketing of just 5 crores which is quite low for a Consumer Facing brand where Marketing expense is usually around 5%. This ₹5 crores is barely a 1% investment. This would most be events, dinners, and other indirect methods of marketing.

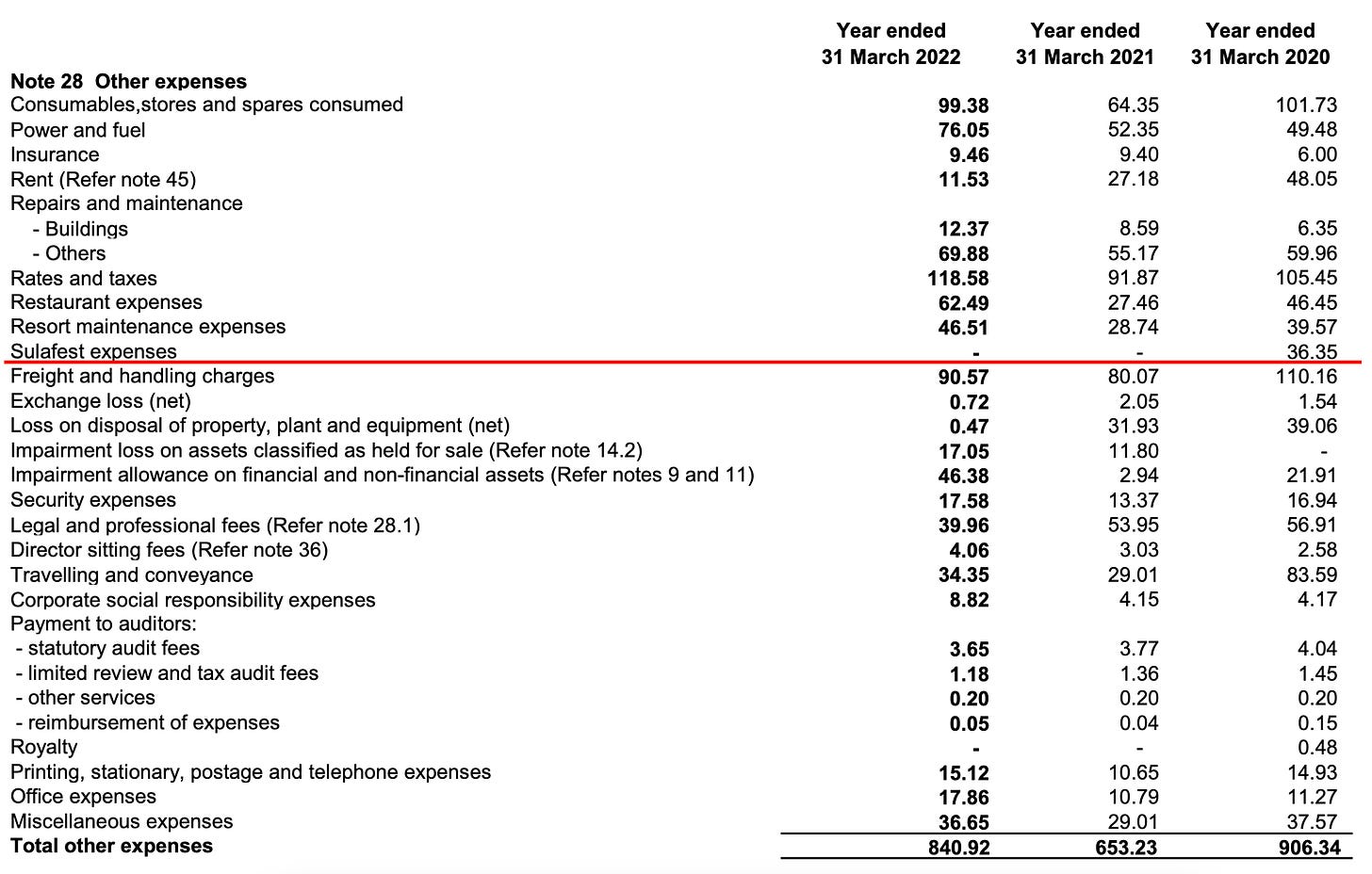

But then you read further down the financials and you find a whole seperate line item for Sulafest. The last time they did Sulafest was in Feb 2020, right before the pandemic, and thus luckily we could see the expense in the FY20 PnL statement - they spent ₹3.5 crores on Sulafest.

In 2020, it was the largest wine festival in India with more than 10,000 people in attendance. It is a massive marketing opportunity for Sula that seems to grow in size every year and completely seperates Sula from the likes of Fratelli and Grover.

Even though Sula is not able to directly advertise its products, they have found a way to break through the clutter (think Bottled Water, Music CD’s, etc. for alcohol brands) and showcase themselves as a truly unique brand in the industry.

Growth of Wine Tourism Business

From the Prospectus:

The wine tourism at the winery will help in creating awareness about the wine which will in turn boost the growth in the wine market.

And as the wine market grows, Sula will grow along with it.

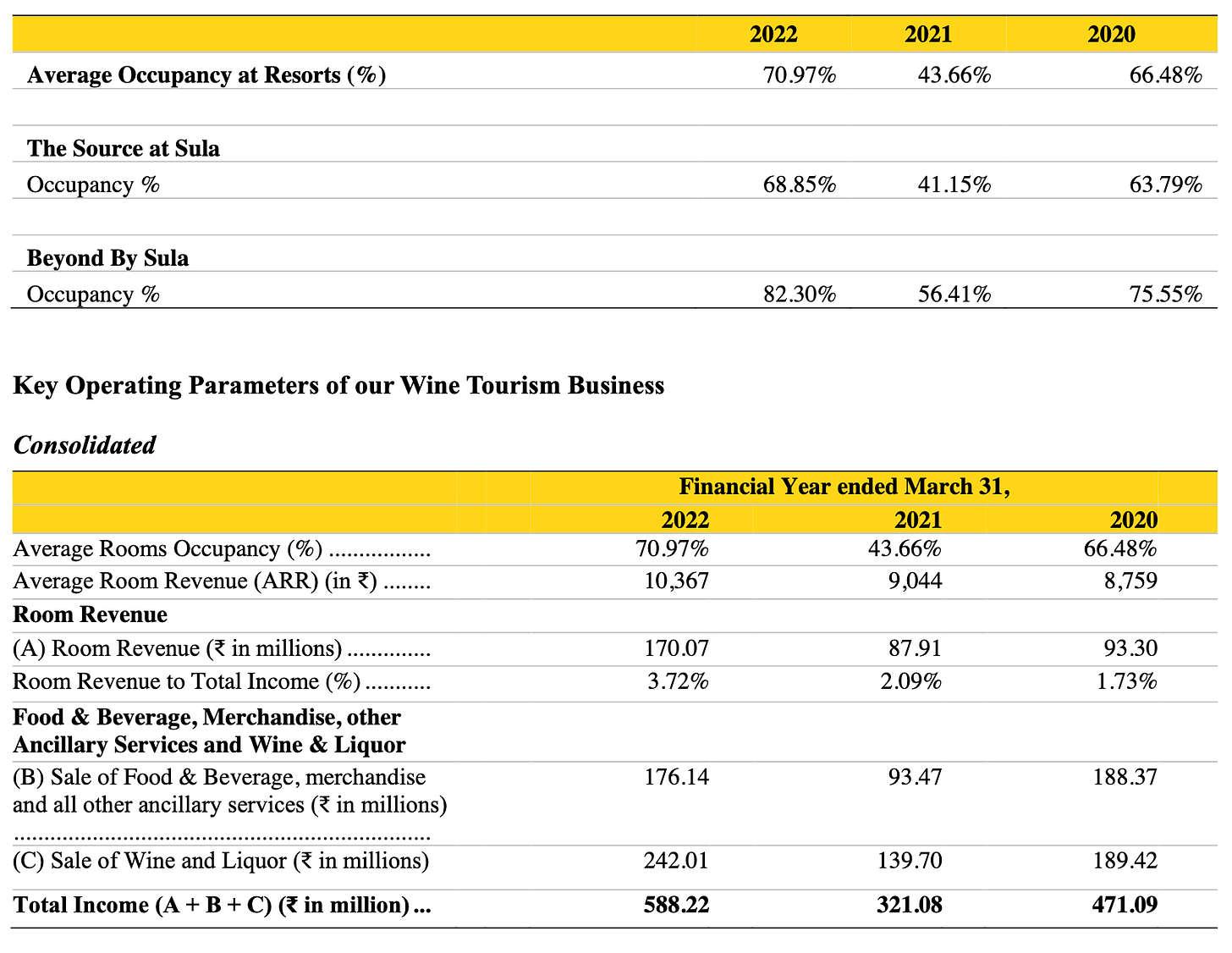

Sula earned ₹58 crores or more than 5% of their revenue from the Wine Tourism business with an occupancy rate of more than 70% in their hotels.

Sula mentioned that they had 370,000 people visiting Sula’s vineyards in FY 2020 but also mentioned that in the US, wine tourism brings in 27 million people and in Italy it is 5 million people. Thus, they’re hoping for a big scope of growth with Wine Tourism.

Additionally, they consider the wine tourism to be a channel for their D2C model. As per the prospectus, they have the highest amount of D2C sales in the Indian wine industry with ₹24 crores. Sula has total control over the experience and data of their customers through this channel which is the defining factor of a D2C business.

As a result, Sula earns ₹58 crores + ₹24 crores = ₹82 crores from their Wine Tourism business. Again, a differentiating factor which gets visitors attached to the Sula brand.

Overall, Sula is very bullish on the Wine Tourism business. From the prospectus:

We expect our future capital expenditures to be, primarily for the expansion of winery capacity and Wine Tourism Business.

Using all of these different marketing & distribution stratgies, Sula has been able to build immense brand power in this industry.

Through their disibution networks, people see Sula across the most number of restaurants and hotels and thus build a brand association with Wine.

Investing heavily in alternative marketing through Sulafest and Wine Tourism is changing the perception of Wine and Sula across the country. Again, Wine and Sula are becoming inseperable in Indian’s minds through these marketing techniques.

Conclusion

Taking everything everything together, what does all this mean for Sula the brand?

Sula’s competitors will find it difficult to compete on purchasing Land, Building Production Capacity and on Branding. Sula has built Scale Economies in Production & Branding.

Sula will continue to dominate the Indian Public’s perceptions when it comes to Wine Companies. Sula has built Brand Power.

We are confident that the management team that has brought Sula this far will stay with the company and will continue to do wonders at the business. Sula has built Process Power with this team.

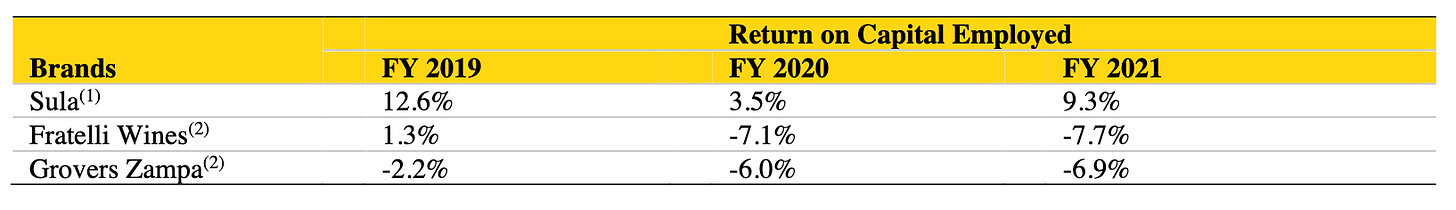

As a result, they Sula has built the biggest moat in the Wine Industry in India. As a result, Sula should be commanding higher returns than its comeptitors. Do we see that in the financials? Yes - quite clearly.

Sula’s Returns improved even further in FY22 with an RoCE of 20.86%.

After this entire analysis - should you apply for the Sula IPO? We are not financial advisors and cannot advice you on what to do. Our sole purpose with this article was to figure out how the Sula brand runs and how it has managed to differentiate itself from the rest of the market. Do your own research before applying for any IPO.

That’s it from us this week! Share this with your friends, family and colleagues who want to stay on top of Market Trends and Business Ideas & Opportunities!

Sahil & Sid