Are you a young leader looking for an opportunity to be the Business Head/CEO of an Industrial IoT based startup? We might have an opportunity for you. Send us a mail and let’s have a chat.

🥡 Takeaways

The giant $10 billion (in India) IoT market will continue to grow at double digit rates in the 2020’s.

Industrial IoT (IIoT) is a larger share of the market and easier for a bootstrapped entrepreneur to find a niche and exploit - niches make riches.

Core use case of IIoT: increase efficiency or reduce costs (preventive maintenance).

India has IoT software capabilities but limited at hardware. Budget 2021 is trying to bring IoT and electronics manufacturing to India.

I know what you’re going to say, “The IoT boom already happened! Even my Fridge is now a ‘Smart Fridge’ where I can watch Netflix. Stick to your podcasts and stop trying to make predictions about the future!”

I agree with you. The early 2010’s was the first big wave of IoT when every single electronic (and non-electronic) device was equipped with a sensor and called ‘Smart’. You could connect these devices using websites like IFTTT to automate many mundane (re: useless) tasks. I synced IFTTT with my phone in 2014 to create an excel sheet of every time I entered and left my office building. I even got an IoT device for my dog to see how much she walked everyday.

How important was this data and how often did I use it? Useless data that was never used - which, in my opinion, was the core problem with the first wave of IoT.

Product Managers nowadays understand this core problem and new IoT products coming into the market have use cases that are actually useful to businesses and consumers. In this newsletter we’ll explore what’s happening in the IoT ecosystem in India and what opportunities are still available to build a profitable business around IoT.

Let’s get the basics out of the way first.

What is IoT?

The full form of IoT is the ‘Internet of Things’.

Simply put, IoT involves putting a sensor into an object that allows it to connect to the internet and/or other devices.

For example:

Step 1: I add a small IoT device to my running shoes (like these).

Step 2: It links back to my phone using bluetooth and sends data about how I run.

Step 3: My phone sends that data (over the internet) to the sensor company’s central database.

Step 4: I can view the analysis of my running on the app or their website.

🧐 Market Gap

The Jio effect means that nearly everyone in the country is connected to the internet.

Communication networks are now widely distributed across the country.

Why can’t nearly every device be connected to the internet?

IoT sensors have reduced in price significantly over the past decade.

The price of an IoT “sensor has declined from $1.30 in 2004 to $0.44 in 2018”.

Through Digital India, the Smart Cities Mission, tying loan disbursals to the adoption of Smart Meters, and many other programmes - the Indian Government is pushing the adoption of IoT at a massive scale.

Through my own attendance at industry events and discussions with companies - there is a LARGE gap between government mandates and the actual manufacturing capabilities of Indian companies for key components of the new Smart future that the government envisions.

At the same time, the new trade war with China and the de facto ban of many Chinese products for sensitive infrastructure, the gap between Demand & Supply has only widened (and therefore opened massive opportunities).

Budget 2021 introduced ₹1.97 lakh crore ($28 billion) of Production-Linked Incentives including ₹40,951 crore ($5.9 billion) for mobile and specified electronic components, ₹5,000 crore ($700 million) for electronic/technology products and ₹12,195 crore ($1.7 billion) for telecom and networking products.

This will include incentives for Consumer Wearables and other IoT hardware which is sorely lacking in India.

Improved electronic component and telecom/networking manufacturing in India will also help improve the domestic IoT ecosystem.

With the expected pace of adoption of Electric Vehicles in India over the 5-10 years - there will be a surge of internet connected 2 wheelers and 4 wheelers connecting to the grid and back to their manufacturers.

The electrical grid will need this data to manage output levels.

Manufacturers will have many opportunities to monetise this data - we’ll discuss it in the opportunities section.

💰 Market Size

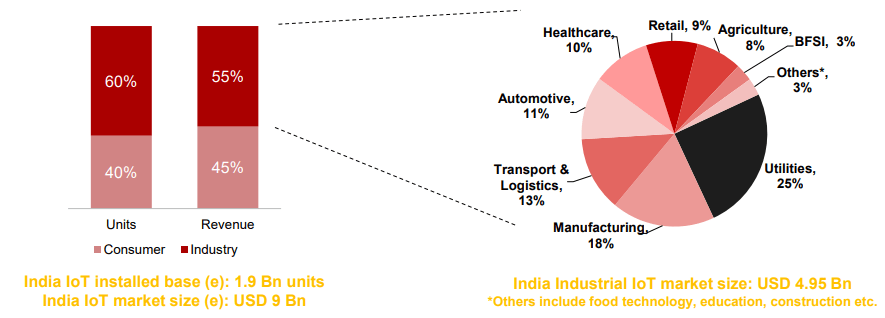

According to some estimates, IoT will see revenues of $11.1 billion in 2022. We can break down the IoT industry into several segments.

IoT Market Segments

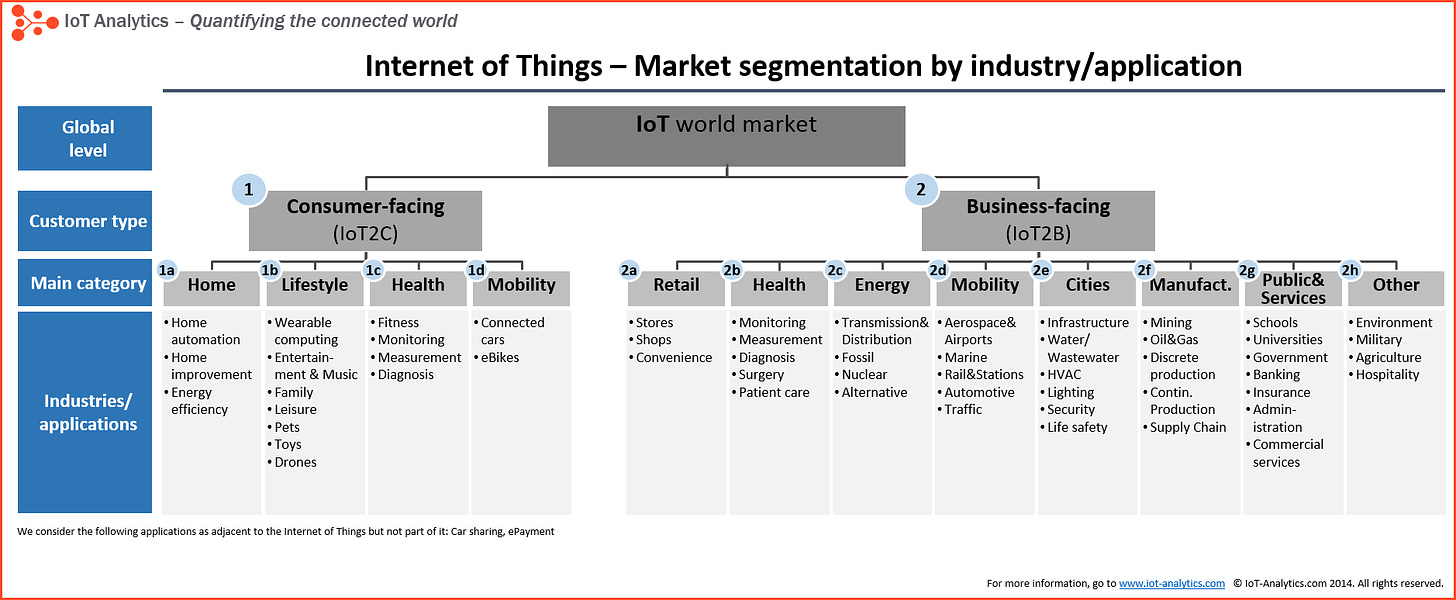

The market size between Business and Consumer applications in IoT approximately 60:40 globally. Within the business segments, “energy, mobility, and manufacturing are leading the way in IoT adoption/investments”. These largely falls into the area of Industrial Internet of Things or IIoT. On the consumer side, IoT largely comprises of Home Automation, Wearables and other such applications.

Industrial Internet of Things (IIoT)

Globally, Industrial IoT or IIoT is expected to grow at faster than 20% for the rest of the decade. In India, IIoT has already surpassed consumer applications in market size.

🧗🏽♂️ Process

A bootstrapped process:

Identify a niche problem in a niche industry - something that’s not ‘sexy’.

Find buyers in that niche and customise a solution.

Productise your solution.

Find other clients in the same niche and sell to them.

Expand by solving other problems in the same niche.

Example: A recent podcast guest bootstrapped their business by selling a thermal imaging IoT solution to a coal mine and then using the proceeds to build a product.

🥊 Players

IoT Networks

IoT devices use different communication protocols depending on their use cases. For example:

Smart Watches use bluetooth to connect to mobile phones.

Smart TV’s use WiFi since they’re generally at home.

Smart Phones use the 3G/4G capabilities of Telco’s.

Smart Water Meters are battery powered & use a Low Power protocol like LoRaWAN®.

Each of these networks needs to be available in the area in order for the IoT device to function. Obviously, this is a capital intensive business and there are only a few companies doing this in India, most of them being existing Telcos.

SenRa - Pan India LoRaWAN® Network - A low-power network.

Listen to our Podcast with SenRa’s CTO & COO

Cyan Cannode - French company providing Narrowband RF mesh networks.

Airtel - Narrow Band IoT (NB-IoT).

Vodafone Idea - NB-IoT

BSNL - Skylo to launch “world’s first 5G NB-IoT network over satellite” 🤔

Industrial IoT

Industrial IoT Conference in New Delhi in March.

Connected Mobility

Connected Mobility is the first letter in the CASE acronym for New Mobility which includes Connected, Autonomous, Shared and Electrical Vehicles. We wrote a previous article about New Mobility & Electrical Vehicles in India.

Tekion - $185 million funding

Dealer Management system.

LocoNav - $7.4 million funding

Fleet Management.

Trak N Tell - $5 million funding

GPS tracking for your car.

Fleeca - Investment by Bridgestone India.

Fleet tyre management.

Manufacturing

I first heard the term Industry 4.0 in 2016 at an industrial manufacturing conference in Germany where they would not shut up about it. Since then, Industry 4.0 has emerged as Global Trend that has changed manufacturing in Western markets.

Because of the capital intensive nature of Industry 4.0 (and since labour is so cheap in India), this trend has still not caught on India at the same pace as other countries. Smaller solutions are picking up instead of fully automated production lines - for example, retrofitting existing lines with sensors or using semi-automated lines.

Titan Engineering & Automation Limited

Yes, that same Titan you got at your retirement party.

They built Siemens’s automated plant just outside Mumbai (if I remember correctly).

List of 149 Manufacturing IoT suppliers in India - many of them targeting specific niches.

Energy

Probably the largest & most mature IoT segment in India right now. Energy will include both Oil & Gas and Electrical Distribution with the main use case in the latter being (prepaid) Smart Meters at consumer’s homes.

Smart Meters

Landis & Gyr

Schneider Electric after purchasing L&T’s Electrical & Automation unit for $2 billion.

Oil & Gas

Recently concluded Oil & Gas IoT Summit in Portugal.

There are a lot more that I can’t list.

Consumer IoT

Consumer IoT can be divided into:

Personal Wearables

Home Automation

Many other companies including foreign brands such as Schneider, Legrand, etc.

Data Storage, Analytics & Visualisation

IoT devices generate a LOT of data and industrial applications in particular will require data analytics & visualisation tools.

For example, Smart Meters have started generating reams of data that is still massively underutilised. You will find dozens of academic papers like this one, discussing how this data can be stored and analysed.

There are a lot of opportunities in:

Data Storage

Data Analytics

Data Visualisation

You just have to find your niche.

🛰️ Technology Stack

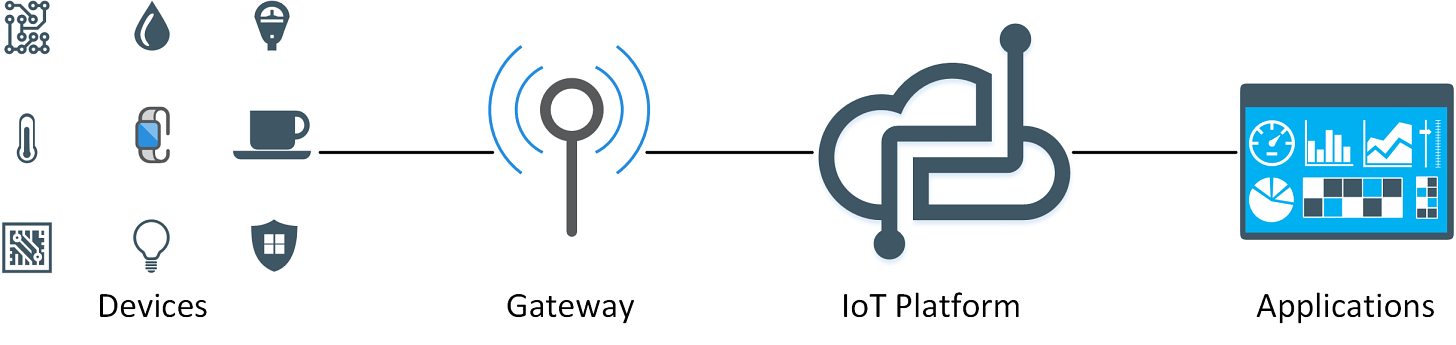

You can simplify the tech stack into:

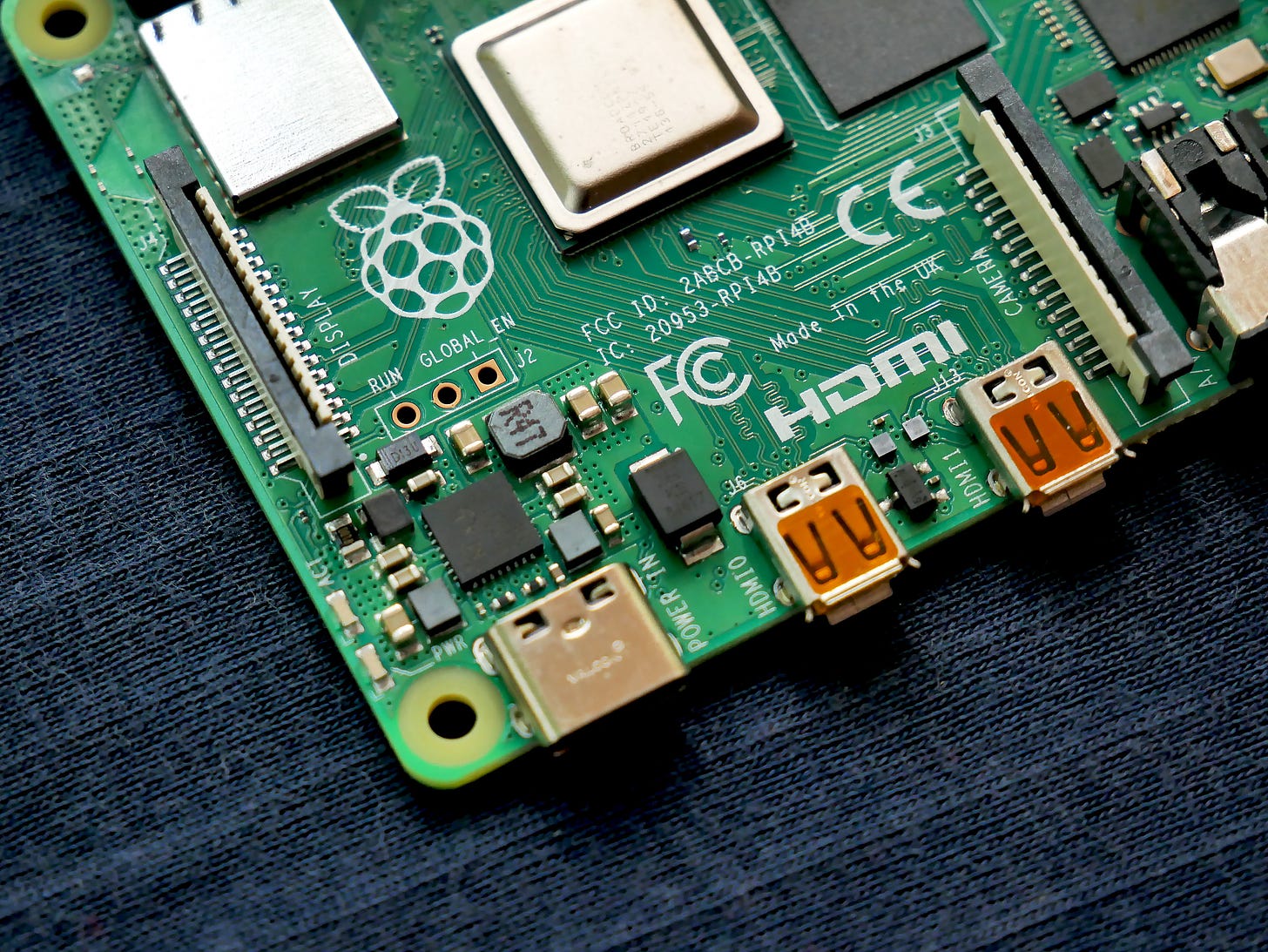

Devices (things) including the sensor - this is the actual object that is sensing the environment and collecting the data. Sensors could detect temperature, humidity, vibrations, proximity, heart rate, or any number of other data points.

Gateway - usually a mix of hardware and software, this step involves encrypting the data, transmitting the data, decrypting of the data, and various other things. Essentially, they are the gateway connecting the data between the device and the IoT Platform where it will be collected.

IoT Platform - “IoT platforms are the support software that connects everything in an IoT system. An IoT platform facilitates communication, data flow, device management, and the functionality of applications.” - Source. Here’s a more detailed article about the IoT Platform market and opportunities.

Application Layer - Essentially the interaction layer with the customer.

🙏 Our Predictions

IoT in India will continue to see double digit growth, especially in the Industrial IoT segment where there are endless niche problems that still haven’t been solved.

The Government’s Smart City Mission will continue facing hurdles and the timelines of implementation will be extended but these will drive innovation as startups and large companies alike look to bridge the demand-supply gap.

Take the Smart Meter rollout for example. It continues to face hurdles and miss deadlines but new companies are entering the market to get even a small piece of this gargantuan pie.

Manufacturing of Consumer Wearables & IoT hardware is going to significantly increase because of:

the China trade war.

Government incentives.

Consultants/Architects/Developers will continue adding to Home Automation IoT devices to their projects across the value chain as these products continue to reduce in cost and reduce maintenance/personnel burdens.

My home has IoT enabled fans - I hate them.

B2B Manufacturers making low value added products will try to move up the value chain through new IoT or SaaS based service offerings.

Especially preventive maintenance using IoT products.

🛒 Opportunities

White Label Manufacturing for consumer wearables brands who are looking for alternatives to Chinese vendors.

Sell the shovel in the gold rush

Consult manufacturers or service providers who are looking to add an IoT product to their basket.

Consult manufacturers on how to move their production to Industry 4.0.

Start an Embedded Systems or Electronics lab to help startups or businesses to build IoT devices cheaper than doing it in-house.

Build an electronics/communications/IoT testing lab as per international standards. This will allow you to get international business as well.

Manufacturers can use IoT to build a service level on top of their existing products for preventive maintenance.

For example, car manufacturers can sell preventive maintenance plans to customers. Or other brands can build a retrofit product for preventive maintenance.

Retrofit expensive machinery or infrastructure with IoT devices for preventive maintenance. Can also be sold with an annual service plan.

This is being done for Distribution Transformers for monitoring & maintenance.

Fleet management at a logistics company for example.

Example of Voltas doing it for their HVAC clients prior to 2018.

Sell an IoT connected consumer product at a loss so that you can sell a monthly service on top of it.

An exercise bike connected to the internet with a monthly subscription for exercise ideas? Sounds like a $42 billion idea.

Help businesses customise products & services for individual customers using granular data from IoT devices.

Also applies to large utilities (electricity, water, gas) who are now capturing household level data on usage.

Generate content about IoT in India (write blogs, podcast, etc.) to build a content business and monetise through the community or advertising.

Many IoT based keywords are still very easy to rank on in India.

I found a few Indian IoT Blogs but the top one has a domain authority of 24 and organic monthly visitors of only ~3,000.

I’m sure you can do better.

Transfer Chinese/Israeli/other IoT technology and manufacture in India on a licensing agreement.

R&D is a long process - might as well find a shortcut.

Or became an agent to connect Indian manufacturers with foreign licenses.

Like License Works but for the IoT Niche.

Develop data analytics, analysis or visualisation tools for an industry niche.

IoT devices generate A LOT of data and most companies are not able to exploit it efficiently.

For example, Ginjer from Senra.

Identify an industrial problem and then try to solve it with IoT.

Build a Micro-SaaS product for IoT applications.

🧐 Looking to explore this market?

Send us an email and we’ll be happy to connect you with people we’ve spoken to in this market.

Internet of Things(IoT) has taken on the job of sensors and has evolved to a new level. In IoT based smart agriculture, for example, a system is constructed to monitor the agricultural field using a variety of sensors (light, humidity, temperature, and so on) while also automating the irrigation system at UbiBot Online Store.