Understanding ONDC - The Future of Indian eCommerce 🏪

Deep Dive into the Open Network For Digital Commerce

The Open Network For Digital Commerce (ONDC) has been in the news a lot in the last few months because it is expected to completely reshape Indian eCommerce in the next few years. We wanted to learn more so we tried to dig deeper into ONDC. But we couldn’t find a single detailed explanation of ONDC & its benefits that we thought explained the topic well. So, we did what we do best and went straight to the source material and took a deep dive into ONDC and how it is expected to function.

Our Conclusion - after UPI, this is the biggest experiment by the Indian Government to reshape how consumers interact with businesses.

If successful, India could be the blueprint to the world of how eCommerce should be built which allows participation by a much wider group of society. Just like we’re already starting to see with UPI, we could one day see the ONDC model shipped across the world.

In this article, we’ll answer the following questions:

How does ONDC fit into India’s digitisation plans?

What is wrong with the current state of eCommerce in India?

How does ONDC Work? (with an example)

What are the Possible Benefits of ONDC?

What are the Possible Challenges with ONDC?

When does ONDC launch?

Who owns ONDC?

Who manages ONDC?

ONDC is a complex subject that took us some time to fully understand. We go into depth on the subject in this article but if you have any questions, feel free to comment or just reply to the email - we’ll try our best to answer your questions.

References:

Jefferies Report about ONDC - tonne of details not available elsewhere.

Twitter Thread by Aditya Kondawar - helped us structure our thoughts.

Building the India Stack

The Indian Government is on a digitisation spree - Aadhar, UPI, OCEN, ONDC, and more. They all have one thing in common - allowing a larger population of Indians involved into what the elites were already doing.

Aadhar for Identity Verification - helped get bank accounts for millions of people through multiple government schemes.

UPI for Digital Payments - even the smallest vendors now take digital payments through UPI.

OCEN for MSME Credit - providing easier credit for these Small Vendors who are recently digitised. Watch our long form video on OCEN.

ONDC for eCommerce - taking e-commerce to the heartlands of India.

Jio Effect - none of this would be possible if data rates in India did not plummet due to Jio entering the market.

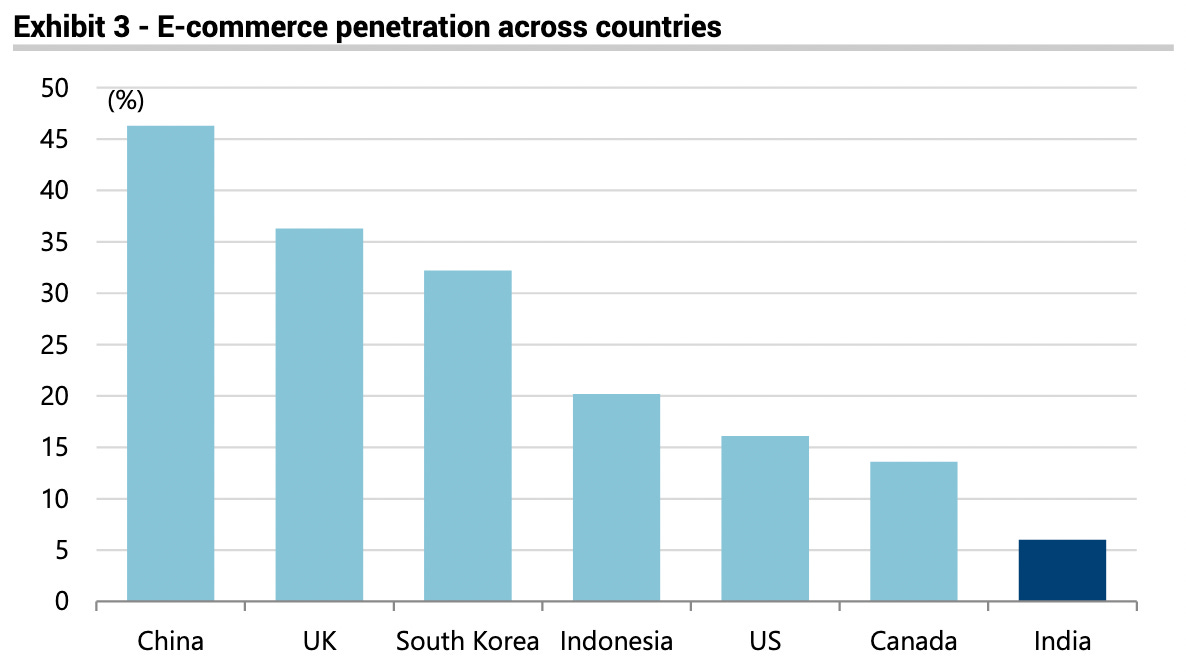

ONDC fits into this mould of digitisation for broader participation of the Indian population. The further we go into rural India, the lower eCommerce participation rates become for both consumers & sellers. Micro Sellers (think Kirana stores or a small clothes shop in the market) even in India’s biggest cities find it difficult to compete online. ONDC wants to solve this problem.

Before we go into more detail about ONDC, let’s answer this fundamental question -

What is wrong with the current state of eCommerce in India?

1. Too Much Control by the Platforms

In 2021, Amazon & Flipkart together controlled 63% of the Indian ecommerce market. And these platforms are the man intermediaries for transactions. And these platforms charge ~30% of the transaction value from the vendor - thus capturing most of the value from the transaction.

Not only does this limit Customer & Seller power, but this also limits the penetration of eCommerce into Rural India.

Let’s assume the task of the Govt is to get the next hundred million shoppers online - these will come from Rural India. But, the current system has limited reach in rural markets because of its centralised nature. The infrastructure required, including warehousing, hyperlocal delivery, etc., cannot be built by Amazon & Flipkart.

As a result, despite Covid, India’s e-com purchase penetration is only 8% of total retail sales. Much less when compared to the rest of the world.

2. Platform-Model Discourages Small Sellers

Presently, a seller has to get listed on various e-commerce platforms to showcase their product. This means that a small seller has to onboard and then manage their inventory across various platforms which is difficult for micro stores in India. These platform-centric models limiting transparency, independence and discoverability of seller. This includes the abuse of Platform Superpower such as Amazon Basics.

As a result, getting the micro and small enterprises on the platforms has been tough.

The Platform-Centric Model also digitally excluded a lot of hyper-local stores since platforms prefer to centralise their warehousing, payments, logistics, buyers, etc.. Only ~15,000 out of the 13 million Kirana stores that exist in India are currently digitally enabled.

3. Amazon & Flipkart are Foreign-Owned Entities

Ecommerce in India is dominated by 2 foreign owned entities:

Flipkart is owned by Walmart and

Amazon India is owned by Amazon US.

This does not sit well with the Indian Government which wants to step in, shake things up and allow newer entrants into Indian eCommerce using ONDC.

How does ONDC Work?

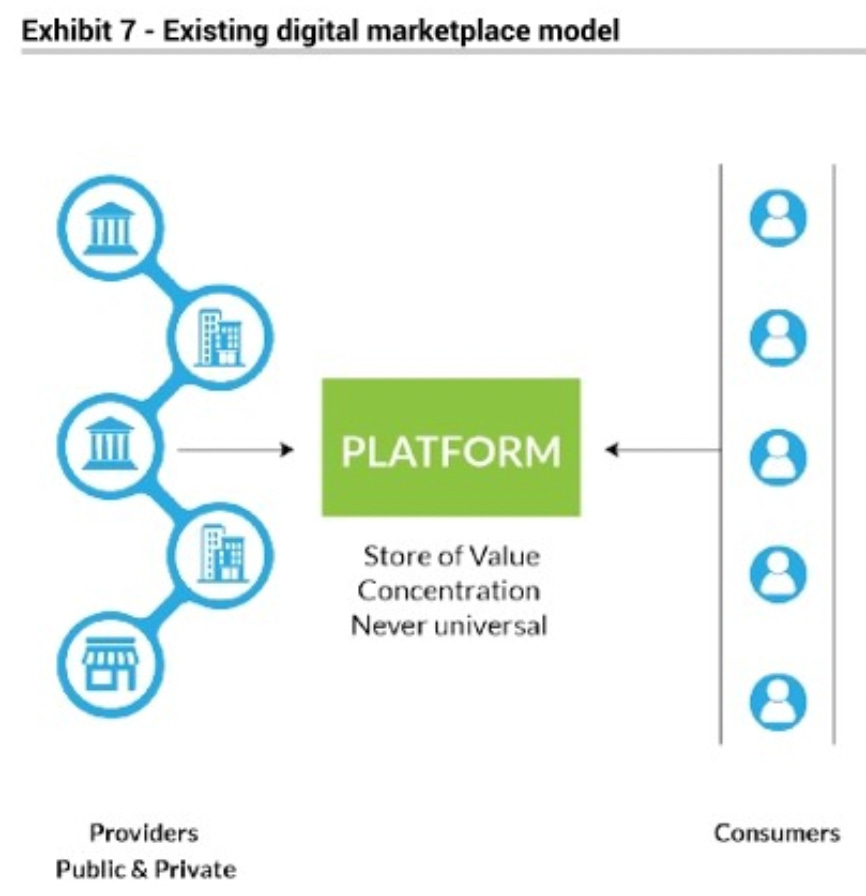

Currently, online marketplaces (Amazon, Flipkart, Snapdeal) follow a platform model. In this model, they have end-to-end control over the entire e-commerce transaction process, right from seller on-boarding, customer acquisition, order fulfilment, complaint redressal, and managing payments. Right now, all these processes are being controlled by a single entity.

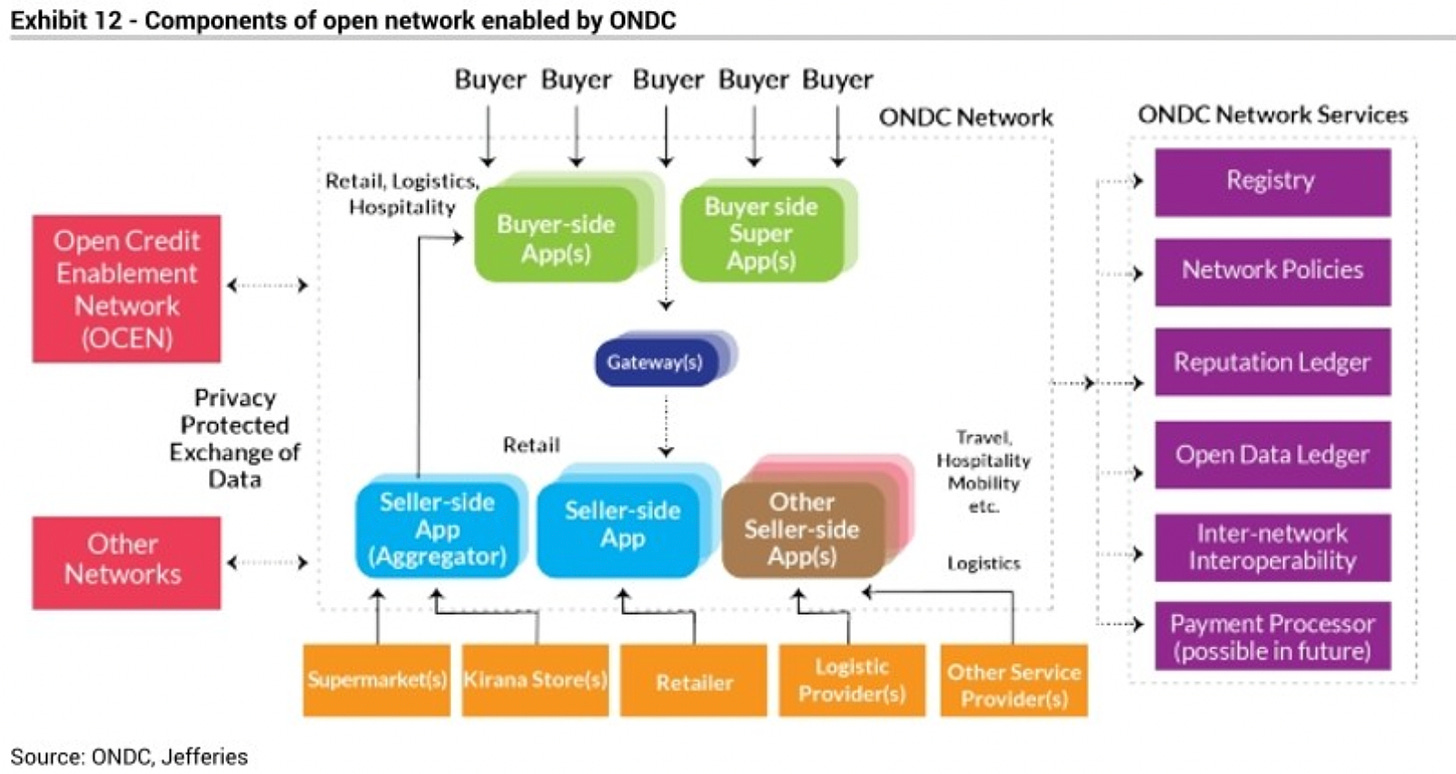

ONDC's open network will 'unbundle' or break down this complex system of small activities into separate micro-services that can be addressed separately by any entity. These organisations can choose to perform one or more of these activities. As a result, the proponents of ONDC say that if it is successful, ONDC will democratize eCommerce, increase competition and accelerate growth.

Spend some time to fully understand the diagram below.

ONDC is trying to recreate the magic of UPI. In the UPI model, it was just the protocol on the backend and Google Pay, PayTM and others built the front-end apps that we see. ONDC is trying to do the same thing. It is breaking down each of these eCommerce processes and have the protocol on the backend. For example, a business like Shiprocket can build the frontend for the order fulfilment part of the journey.

The 6 Components of ONDC

Buyer-Side Apps: will interact with the buyers and is responsible for demand generation or transaction origination. Ex. Amazon

Seller-Side Apps: will interact with sellers which can receive buyer requests and publish their catalog of goods and services and fulfill buyer orders. Ex. Amazon for Sellers

Gateway: Sends out a search request received from buyer apps to all seller apps.

Beckn Protocol: an open, interoperable and universal transaction protocol.

Open APIs: allow exchange of information for execution of transactions.

Open Registries: list of participants who join ONDC, network policies, etc.

ONDC Transaction Example

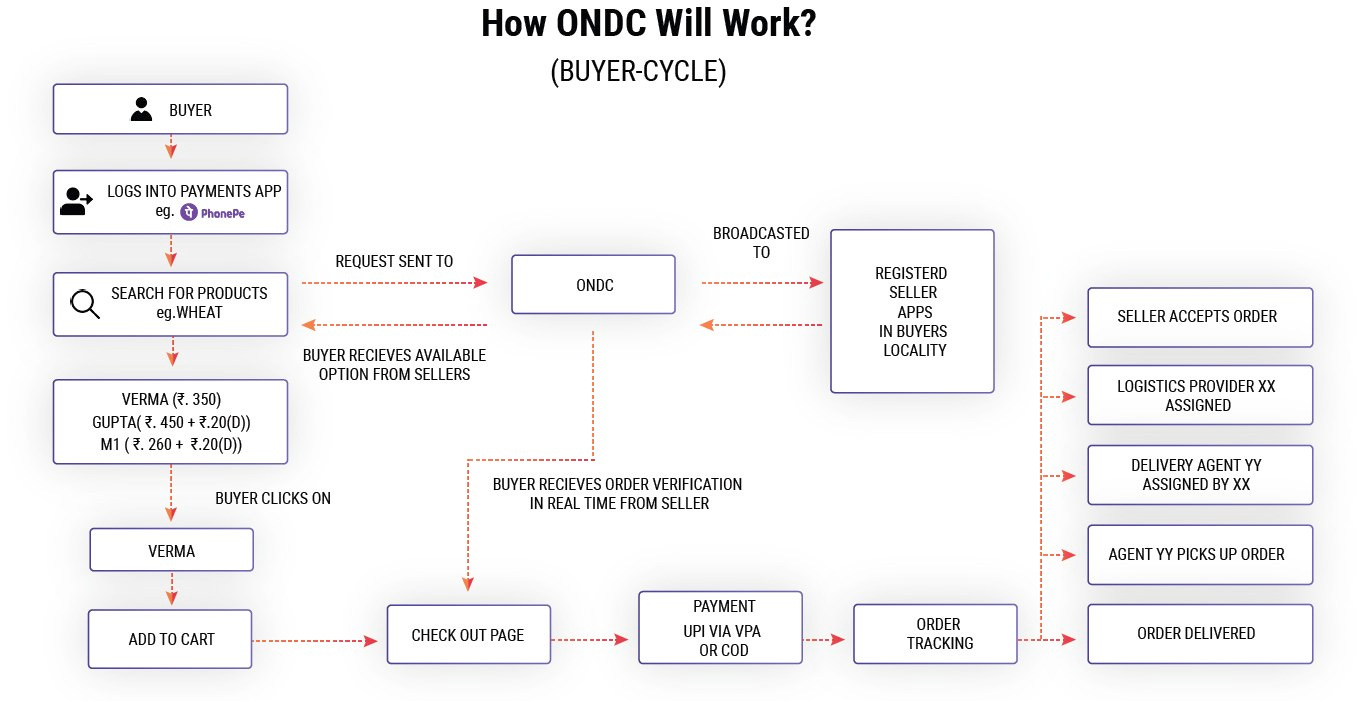

Let’s take an example of the journey of a customer on the ONDC Network

Step 1: Customers logs on to Paytm. Paytm doesn't have a big e-commerce offering right now, but once the ONDC network is established, it can use the listed sellers and maximise the customer footfall it already gets for its app for e-commerce transactions as well.

This customer searches for a product, say '5 kg Sona Masoori Rice Bag'.

Step 2: The gateways will check the registry and send a search to all the retail seller apps. Assume the following options are displayed.

Gupta Kirana stores - Rs 200 (w/o delivery)

Nearshop (fulfilled by Modern Kirana Store) - Rs 260 (w/ delivery)

Step 3: Assume customer places order with Gupta Kirana Store (w/o delivery). They can then add delivery service from a vendor of choice listed on the platform and available for the location. Assume Dunzo offers delivery at Rs50 and Goodbox at Rs60. Customer can opt for delivery through Dunzo.

Step 4: Now the customer can choose a payment option available for the seller apps including UPI, Cash on Delivery, etc.

What are the Possible Benefits of ONDC?

Quote from Infosys founder Nandan Nilekani who is spearheading this project and was also in charge of Aadhar.

We have a chance to start over and remake the digital world to be more fair and transparent for all participants. With ONDC, we hope not only to create a level playing field for India and all the businesses operating there but also provide a glimpse for the whole world of how open commerce can drive positive non-zero-sum outcomes for business and society.

Increased Customer Choice - Customers will now have a lot more options with each part of the journey than they do right now.

Developing Hyper-Local Vendors - Will allow a lot of hyper-local partners to develop, especially in delivery. You can maybe just have a delivery service who only caters to one extremely dense neighbourhood in Mumbai and they’ll be able to generate demand through ONDC. Previously - they would not get discoverability on any apps.

Reducing Platform Commission to 3% - One big change through ONDC will be that it caps referral commissions for platforms that send shoppers to a seller at just 3% – much less than the roughly 30% cut charged by Amazon, Flipkart and others.

Seller Data will become Open Source - All Marketplaces who register on ONDC will be able to access the database of all the sellers. But one of the biggest Moats that the giant e-commerce players have is their Sellers - Flipkart has 375,000 Sellers and Amazon has 850,000 sellers on their platform. Onboarding these sellers must’ve been a big cost and headache to Flipkart and Amazon. Therefore, if I decide to start a new marketplace, I can get the same database of sellers that Amazon has available on ONDC. Will be interesting to see how this plays out.

Increased Access to Small Sellers - Right now, small sellers only want to list on the big platforms because selling on multiple platforms requires a lot of work including inventory data that needs to be updated. With ONDC - the backend protocol will push the same data to all marketplaces. Even the smallest sellers just have to update one system and can easily access all the biggest marketplaces.

Kirana Explosion - Imagine the 13 million Kirana stores that exist in India jumping onto ONDC - this matters because ONDC is also built for food and grocery delivery. Since Amazon, Flipkart & Reliance Retail have expressed their interest to join ONDC, we may see 12-15 million Kirana stores selling their products through ONDC to their nearby areas more efficiently.

Does all of this mean the end for Amazon, Flipkart and the other giants?

No, we think Amazon & Flipkart might become even more dominant than before with access to many more sellers. Why? Because they can spend the money to drive demand generation.

Will e-commerce in India just become a completely disorganised mess with tonnes of small players?

Possibly yes. Let’s dive deeper into this question below.

What are the possible challenges with ONDC?

Implementation will be tough - ONDC is a complex ecosystem to implement, unlike UPI. Under UPI, cash was the only commodity. Cash can be thought of as a single SKU, while e-commerce deals with millions of SKUs. There are a lot of variables involved, including quality of the product, look & feel, freshness in case of groceries, returns and customer support. Hence, customer adoption and executional complexities can be very challenging.

Why should Customers move to ONDC? Payment systems that existed before UPI were very complex like NEFT or PayTm Wallet. However, with eCommerce, people are generally satisfied with Amazon and Flipkart - why will they move?

Not investing in Customer Acquisition early on - Amazon & Flipkart do significant cash burn for customer acquisition, seller onboarding and building logistics infrastructure. Bringing the tens of millions of existing kiranas onto the platform will require a massive, well-funded adoption campaign. But ONDC is just an enabler. Until and unless the buyer-side apps start spending money to get customers on the platform - we won’t see much traction.

No Centralisation might lead to Quality Problems - India doesn’t have regulations for e-commerce customer liability. Who will be responsible for any mishaps in ONDC? If a consumer receives faulty goods, who will be responsible? Wht about double clocking of transactions that lead to a pile of credit reversals - who will solve this? Under ONDC, there is currently no mechanism to ensure returns or address customer complaints if there is a dispute between a buyer and a seller.

Similar models failed to scale up in the past - Though not an open network model, there have been attempts in the online food delivery market to bypass Swiggy/Zomato and help restaurants make direct delivery apps. DotPe and Thrive are direct delivery enablers, helping restaurants build their own digital menus and supply chains. However, traction on these direct delivery apps has been limited even after offering better pricing vis-à-vis Swiggy/Zomato. The biggest is problem is lack of customer acquisition spends. Without that, the reach of the direct delivery apps remains limited.

Seperation of eCommerce Buyers - Amazon and Flipkart may differentiate customers who’re using ONDC vs. the full form of their website - maybe a toggle button on the app. Amazon already has Amazon Prime.

Amazon & Flipkart becoming even more dominant - UPI is also open source but it became dominated by Google Pay, and a few others. Will the same happen with ONDC being taken over by Amazon and Flipkart since they will continue spending heavily on customer acquisition.

When does ONDC launch?

The platform was launched on 8th May 2022 as a pilot programme across five cities—Delhi, Bengaluru, Coimbatore, Shillong and Bhopal. PayTm will act as the buyer app and it has roped in a bunch of other company’s to be the seller side apps. ONDC plans to onboard 150 sellers across the five cities for the pilot.

ONDC is in advanced discussions with over 80 companies for integration including Paytm, PhonePe, Reliance Retail, Google Pay and a logistics providers like Grab.in, Dunzo, Ekart, Shiprocket and lots of other companeis . The network won't be restricted to retail, but would include food delivery, mobility, wholesale trade, hospitality, travel and tourism.

The network plans to go national by August 2022. Nothing in the news so far about this.

Who owns ONDC?

ONDC was incorporated as a Section 8 (not for profit) company in Dec '21 and Majority ownership is with private sector institutions to ensure alignment of goals with the market, and flexible and agile decision-making. Nearly 41% of ONDC is owned by 5 Indian Banks.

ONDC Team

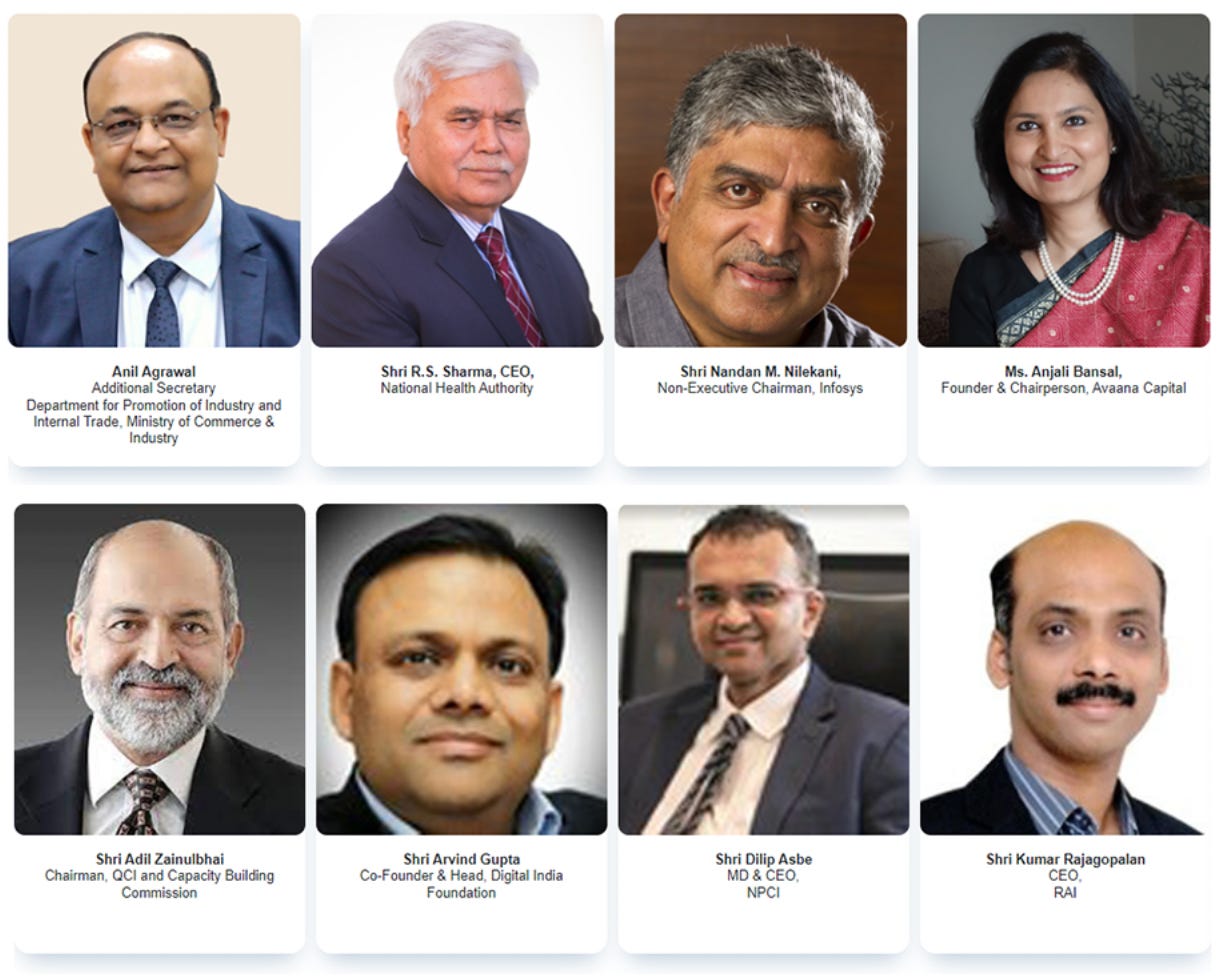

The team and includes the pioneers of many of the successful government-led digital projects including UPI, Aadhaar, Rupaay, IMPS, and GST. Includes Mr. Nandan Nilekani (Infosys co-founder) and Dilip Asbe (MD & CEO of NPCI).

Good Things Take time

ONDC aims to have 25% of all internal Indian commerce occur online within 2 years. That’s triple the current online penetration rate of 8% of internal commerce.

But remember, it took UPI took 2-3 years and Covid to take off. Time will show the platform's result! But, this is a much more complex project for implementation than UPI and we should be patient.

TID Opinion - For governments around the world, ONDC and UPI are showing what open retail might look like in practice. In the end, everyone –shoppers, merchants, and even giant platforms– will benefit from turbocharged e-commerce adoption and the creation of a larger global economic pie if we go from that 8% e-commerce to 25% rate in the next 2 years.

That’s it from us this week! Share this with your friends, family and colleagues who want to stay on top of Market Trends and Business Ideas & Opportunities!

Sahil & Sid

Great analysis and very in-depth!

I had been looking for something on ONDC for quite some time, it's surprising how little information is available in the public domain!

A few thoughts after reading this:

1. Seller Data will become Open Source: Does this mean Amazon/Flipkart seller data becomes accessible to everyone? Unlikely that they'll give up their prized data easily. Maybe they'll bifurcate the database to pre-ONDC and post-ONDC, possibly launch a new sub-brand just for ONDC

2. No Centralisation might lead to Quality Problems: This was my first thought as well, Flipkart/Amazon have solved significant operational challenges (ok, well maybe not Flipkart!) over the years, ONDC will face the same, and some even amplified, because of multiple nodes and levels of sellers involved. Could this be an opportunity for a business to help solve this? Is ONDC open to third party solutions?

3. 41% of ONDC is owned by 5 Indian Banks: Who owns the remaining 59%? Are the names of these private sector institutions not public? Raises some questions...

Overall great analysis, would love to see some business opportunities being discussed around ONDC.

Cheers!

Glad to discover this newsletter, keep it up